What happened in July?

July by the numbers:

U.S. Equities | S&P 500: 1.4%

International Equities | ACWI ex-U.S.: -1.2%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: 0.2%

Global Bonds | JP Morgan Global Aggregate Bond Index: -0.2%

Moving into August

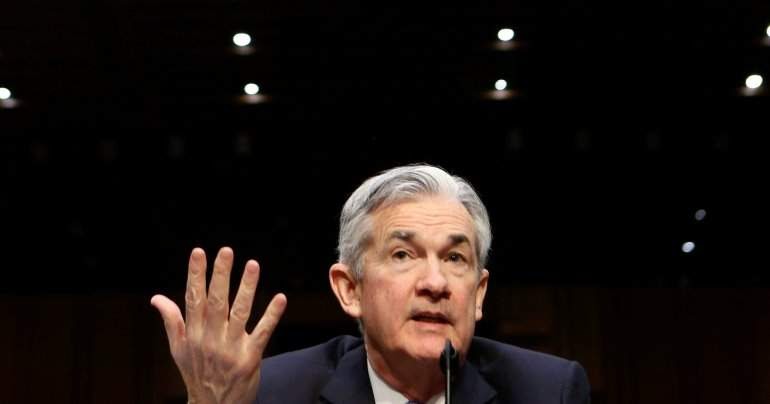

The U.S. Federal Reserve’s decision to cut rates but exclusion of a clear path forward has reintroduced some uncertainty regarding the next steps of the central bank. Investors will be looking for any sign pointing to whether cutting rates was a good decision and what the next meetings will have in store. U.S. and China trade is still very much a market moving topic that progressed slowly during July. With discussions having resumed at the end of June, there may be news on the horizon that could cause market action in either direction. Domestic economic data remains relatively strong, but there are still signs of a global economic slowdown. Quarterly earnings have been generally positive, though geopolitical risk still remains. We currently sit 70% invested in our U.S. equity strategy and 82% in our international equity strategy.

NorthCoast Navigator

|

Negative Indicators |

Neutral Indicators |

Positive Indicators |

|

|

Valuation There was little change to valuation indicators in July. A slightly positive month for equities and few if any big surprises in quarterly earnings reports kept P/E ratios in line with the end of June at 19.3 as of July 31 |

Sentiment Sentiment indicators moved slightly lower from last month, though no significant move of data points occurred. Slight weakening occurred as data showed tighter requirements by credit issuers and slightly higher expectations of an economic reversal.

|

Macroeconomic The Federal Reserve confirmed the U.S. economy’s strength in the press release and conference by Jerome Powell. They recognized a healthy economy as the reason for not signaling further rate cuts. Unemployment remained near record lows and GDP growth stayed solid. Inflation was the only laggard, but has been for some time. |

Technical Technical indicators remained positive with domestic equities moving higher in July. The S&P 500 remained comfortably above its moving averages, notably being 7% above its 200-day moving average. Relative strength index, a measure of momentum, moved slightly lower due to July being less positive than June’s large gains.

|