What happened in May?

U.S. equities moved higher in May as positive fundamental data prevailed over headline news. Macroeconomic data continued to paint a rosy picture of the U.S. economy with consumer spending ticking higher in April driven by rising incomes and higher employment. The final tally from first quarter earnings was positive for companies in the S&P 500. In contrast, numbers released by the Commerce Department showed that corporate profits grew by a small amount in the first quarter from a year ago and, without the added benefit from the tax overhaul, profit growth would have been lower.

Geopolitical events were in focus throughout the month. The markets reacted rather severely to news of a new Italian government that may center on skepticism towards the Eurozone. Investors were worried about the state of Italian debt if the country decides to move back to the devalued lira and out of the Eurozone’s economic protection. These political concerns and U.S. trade tariffs impacted the EU market negatively in May. Emerging markets continued to struggle as the U.S. dollar strengthened, making their dollar denominated debt more expensive and pulling investors away from the riskier asset class. At the end of the month, the U.S. decided it would implement tariffs on steel and aluminum products from Canada, Mexico and the EU. This move raised concerns over potential retaliatory trade policies from these countries as well as the impact of higher priced goods on manufacturers and multinational corporations.

May by the numbers:

U.S. Euities | S&P 500: +2.3%

International Equities | ACWI ex-U.S.: -2.3%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: 0.7%

Global Bonds | JP Morgan Global Aggregate Bond Index: -0.7%

Moving into June

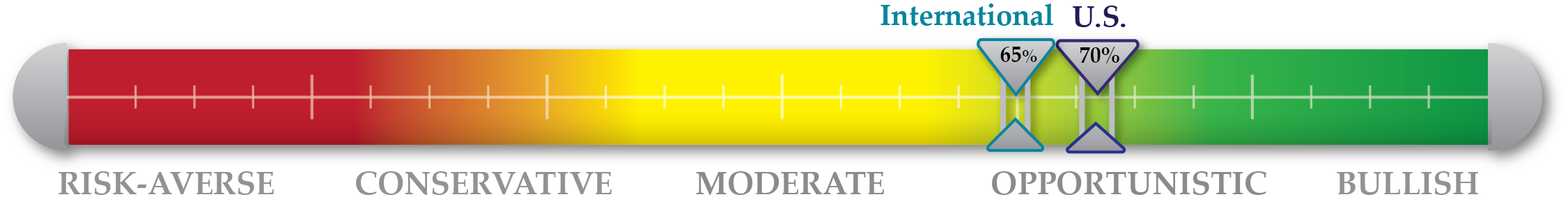

U.S. investors will be watching the Federal Reserve’s June 13th decision on interest rate hikes, the response by the EU, Mexico and Canada to the newly imposed U.S. tariffs, and continued trade negotiations between the U.S. and China. NorthCoast’s cash levels in both domestic and international tactical strategies remain slightly high, 30% and 35% respectively, as we wait on developing information to further understand the impact on the data. We hold this relatively neutral position to maintain a level of protection in the case of a market downturn as well as to retain the ability to invest in new opportunities in case of an upswing.

NorthCoast Navigator

|

Negative Indicators |

Neutral Indicators |

|

Negative Indicators |

|

Valuation Valuation indicators changed little in May with market prices remaining high. The average P/E and forward P/E ratios of S&P 500 companies ticked slightly higher to 20.7 and 17.0 respectively. |

Technical The relative strength index, measuring general market momentum, rose in May after a positive month for the S&P 500. The general market index rose to 3% above its 200-day moving average, and the VIX remained around 15. |

Sentiment The University of Michigan Consumer Sentiment Survey dropped slightly in May but remained over 98. Flows into the S&P 500 equity fund SPY were light but positive, and the Bull/Bear ratio remained steady. |

Macroeconomic U.S. jobless claims decreased again in May as the labor market continued to look strong with unemployment below 4% for the first time in two decades. GDP growth was revised down for the first quarter to 2.2% from 2.3%. |