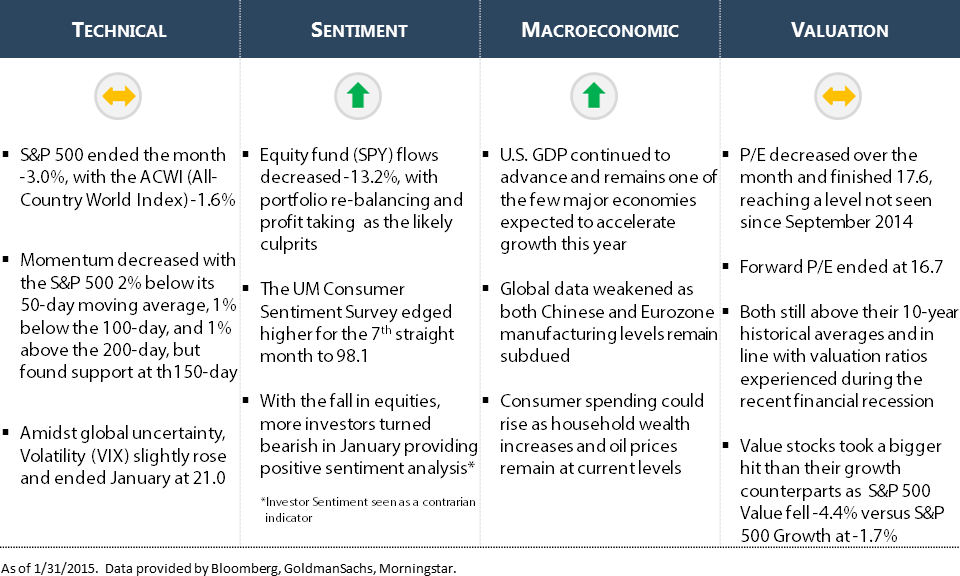

For a second consecutive calendar year, U.S. equities dropped more than 3% in value during the month of January. The S&P 500 ended -3% as global macroeconomic worries and portfolio re-balancing took effect.

The short-term pullback has done little to sway the overwhelmingly positive data for equities. As we near the halfway point in earnings season, 70% of S&P 500 companies who have reported beat earnings estimates while 46% beat sales estimates. The U.S. economy continues to power forward and is one of the few major economies expected to accelerate in 2015. Unemployment continues to fall and if the pace continues, household wealth rise and consumer spending will get a boost, propelling the U.S. economy further.

The "wildcards" of uncertainty continue to center around central banks, oil prices and production, and global economies. The European Central Bank announced a plan for heavy quantitative easing in an effort to keep the Eurozone out of a recession. China's manufacturing index remained below the pivotal contraction/expansion level, raising concerns about the world's second largest economy. And while the 50% drop in oil prices is providing short-term relief, little is known about the long-term health of the commodity and the billions of dollars connected to it.

With the current information at hand, NorthCoast remains cautiously bullish or "Opportunistic" in this environment, with our tactical portfolios between 90%-100% equity invested. We will continue to monitor the data points daily and make adjustments if necessary.