Still Recovering but on Watch

In April, the market rose higher amidst the strong backdrop of an accelerating vaccine rollout, good economic news, stronger than expected earnings, dovish Fed messaging and President Biden’s infrastructure and families proposals. The S&P 500 gained 5.2%, its best month since November 2020, while the Dow was up 2.5%, and the Nasdaq gained 5.4%. Returns among sectors varied with REITs, consumer discretionary, communications services and financial sectors outperforming. Although rising oil prices in the last week helped boost energy stocks, the sector finished the month flat. Consumer Staples were also relatively weak, gaining 2.2% in April. Technology stocks gave up some of the gains in the last week, weighed down by a decline in Microsoft despite its better than estimated earnings.

Investors were encouraged by recent economic news. U.S. GDP increased at a 6.4% annualized rate in the first quarter. For three consecutive weeks in April, initial jobless claims held below 600,000 with the third weeks’ claims dropping to the lowest level since mid-March last year before the pandemic. Retail sales grew by 9.8% in March, one of the largest gains in the history of the sector. Although we view March sales levels as unsustainable going forward due to the stimulus lift, we believe that increased household savings (+US$2 trillion since the pandemic began), combined with rapid job growth and fewer restrictions on activity will keep consumer spending strong.

Both producer and consumer sentiments were boosted in April. Signs that the U.S. economy is set to take off are becoming increasingly obvious as the PMI manufacturing index jumped to 64.7 in March. Consumer confidence also surged over the last two months, with the Conference Board Consumer Index rising to 121.7 in April from 109 in March. Though consumer confidence is still slightly below pre-pandemic levels, sentiment has rebounded more quickly than it had following the past few recessions.

Going forward, we believe that in the very near term the economy will remain well positioned to continue on its current stimulus and vaccination-fueled path. Given more recent bullish data points, we recognize investors may wonder if all the good news is already reflected in the market. Just as we have warned against extrapolating from the rapidly worsening data at the start of the pandemic, we expect the accelerating growth of the U.S. economy to slow down after the summer. On the tactical horizon, market overreaction to strong growth data may be risky. With investors also pushing stocks to all-time highs, valuations soar with the S&P 500’s trailing P/E a robust 31 times earnings – itself a warning sign. Overall, we expect that the current low market volatility will not persist with concerns over rising inflation, fears of possible tax hikes, and investor speculation over Fed stimulus decisions.

By the Numbers (Year-to-Date)*

U.S. Equities (S&P 500 Index) | 11.7%

International Equities (MSCI ACWI ex-U.S.) | 6.5%

U.S. Bonds (Barclays U.S. Aggregate Bond Index) | -2.6%

Global Bonds (JP Morgan Global Aggregate Bond Index) | -3.3%

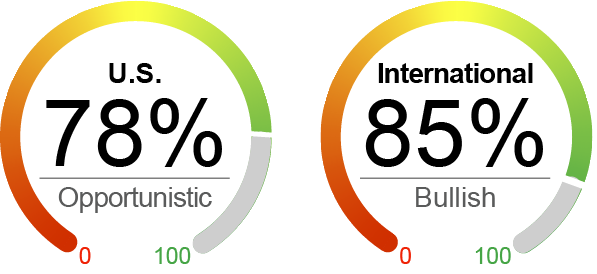

The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. equity outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

As of 4/30/2021. Data provided by Bloomberg, NorthCoast Asset Management.

*Source: Bloomberg, WSJ, NorthCoast Asset Management.

|

Negative Indicator |

Neutral Indicator |

Positive Indicator |

Positive Indicator |

|

Valuation With the rotation out of the tech and growth sectors, the relative valuation of this sector has improved slightly. Overall, however, valuations are generally still very high and equities appear overvalued. P/E ratios increased with the market rise from 30.88 at end of February to 32.43 at end of March. |

Sentiment Sentiment is still below its pre-pandemic levels, but it is at its highest level since the pandemic’s start. The University of Michigan consumer sentiment survey was up to 85 from 77 a month earlier. Stimulus and solid economic data, such as net job gains, are driving the rise. |

Technical Technical indicators remain positive. The broadening of the U.S. equity market’s gains is an encouraging sign of more general momentum throughout the market. At the end of the quarter, the S&P 500 sits comfortable above its main moving averages. Currently is 12% above the 200-day moving average. |

Macroeconomic Strong job numbers and rising sentiment will have hopefully had a knock-on effect of stronger consumer spending, a main driver of economic growth in the U.S. Income growth is expected to be slow for the time being, but net job growth is very encouraging. Proposed spending bills could further boost economic outlook, but their passages will be hard won in a divided Congress.

|

Important Disclosures

The information contained herein has been prepared by NorthCoast Asset Management LLC (“NorthCoast”) on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2021 NorthCoast Asset Management LLC.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF AN INVESTMENT.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.