The U.S. stock market experienced volatility swings that haven’t been seen in a few years. What is your posture toward U.S. large-cap equities (IVV) going forward?

We trimmed the IVV position in our Tactical Growth, Diversified Growth and Diversified Core strategies as our global tactical asset allocation model indicated a more cautious outlook for U.S. equities in the near-term, partially driven by relatively lower technical signals which fluctuated during the volatile quarter. It was only a modest trim of U.S. large-cap equities from a 28% weighting at the beginning of the year to a 25% allocation entering Q2.

There are many strong factors signaling continued growth in stocks. The economic fundamentals remain favorable and the growth rate will likely accelerate with recently approved fiscal stimulus measures, including tax cuts and federal government spending increases. Sentiment signals remained relatively strong with the ISM manufacturing index climbing north of 60 in February, indicating a strong start to 2018. Homebuilder sentiment index also remained solid, indicating a positive outlook for the housing market. Macroeconomic data is bullish as the labor market continued to tighten in February and industrial production output surprised to the upside. The labor market added 313,000 jobs in February with the labor force participation rate increasing measurably to 63%.

NorthCoast is closing the quarter with a less bullish outlook toward equities than when it started. What other positions were impacted in Tactical Growth?

Can you comment on a couple of the key reasons for changes to the Tactical Income portfolio since year-end?

In Tactical Income, two new positions were added – the iShares 20+ Year Treasury Bond ETF (TLT) iShares 3-7 Year Treasury Bond ETF (IEI). The additional positions help diversify the portfolio across the income spectrum as we believe interest rates are likely to rise in the near future and protection against a hike in interest rates is a key objective in Tactical Income. Hence, we’ve transitioned to a barbell approach, which is higher allocation to short- and long-duration bonds with minimum allocation to intermediate duration bonds, to benefit from a flattening of the yield curve. At its basic level the barbell approach works to protect against rising interest rates with the short duration bonds that can be reinvested quickly while also generating attractive income through the long duration bonds. Another key factor for slightly increasing allocation to TLT and IEI is the higher sentiment signals related to implied volatility.

What is your sentiment towards Eurozone equities (EZU) and are you concerned about the possible impact to the region from any future tariffs from the U.S.?

It’s a bit early to evaluate the exact impact to the region from future tariffs from the U.S. as it depends on how other countries respond. According to Moody’s, some economists have forecasted that the global economy could suffer with real GDP reduced by about 0.4% by the end of 2019, but then quickly bounce back once the tariffs are lifted.

A number of sentiment signals in the area declined, including the Eurozone PMI, Eurozone Economic Surprise Index, ZEW Germany Expectation of Economic Growth Index and France Business Confidence Composite Indicator. However, our outlook for EZU remains optimistic largely due to its relatively higher macroeconomic and valuation signals. According to OECD’s latest projections, the Eurozone’s two major economies, Germany and France, should grow an estimated 2.4% and 2.2%, respectively. It is expected that fiscal policy will remain accommodative in Germany this year, while recent reform efforts in France can help kick-start its economy. With the recent decelerated Eurozone inflation, the ECB is more likely to keep the accommodative policy in the near future.

What appealed to you about emerging markets that has led to an increased allocation to the position?

What appealed to you about emerging markets that has led to an increased allocation to the position?

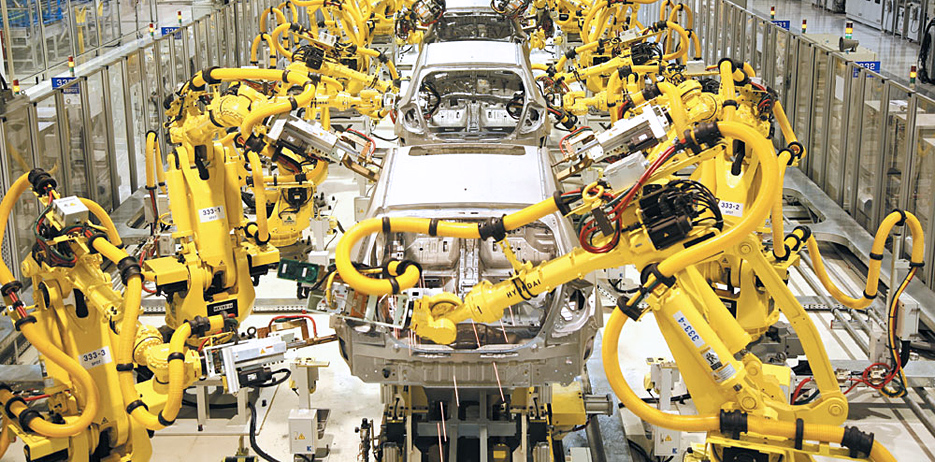

U.S. trade policy and a subsequent retaliation pose increasing risks to the optimistic emerging market outlook. A major part of Trump’s economic agenda has been to take a hard line with U.S. trading partners, with China being a key target. Despite a pending trade war, our Global Tactical Asset Allocation (GTAA) model indicated a bullish outlook for the iShares Core MSCI Emerging Markets ETF (IEMG) as three of the four dimensions of the ETF trading signals - macroeconomic, technical and sentiment - remained positive. Among emerging market countries, China's industrial output expanded by 7.2% year-over-year in the combined January-February period, up from a 6.2% increase in December. Domestic and export-oriented demand is driving China's industrial sector.