Optimism for a New Year

There were a number of remarkable market events in 2020, the most well-known of which was the S&P 500’s rally from its record selloff in March. After losing nearly a third of its value in the spring, the S&P 500 rose almost 70% by year end from its March lows, and notched a gain of almost 18% for the year. The S&P was not alone in its record run - the Dow Jones Industrial Average and Nasdaq both had equally remarkable runs. Together, these three major indexes recorded 100 record closes during the year. For context, that is the most record closes since 2017, a banner year for equities with certainly no pandemic to contend with. Such positive market action was not exclusive to equities however, and it is almost easy to forget that some oil futures traded below $0/barrel in April, having since rallied back to around $50/barrel. The driver of such widespread investor optimism was largely faith in governments and central banks to prop up economic activity through accommodative monetary policy (low interest rates) and fiscal stimulus. Both of these actions did come to fruition with central banks committing to as supportive policies as necessary and governments passing major stimulus bills. The most recent stimulus bill in the U.S. was confirmed last month. These actions were critical to maintaining optimism throughout markets.

The end of 2020, particularly December, was somewhat of an inflection point for what had been driving the markets higher. Investors are moving from optimism about governmental intervention to confidence that vaccines will bring more economic recovery and eventually restore a high level of activity. The Chinese economy has substantiated this belief since it has essentially recovered, now functioning at a high level since the country largely controlled the pandemic’s outbreak. Other countries are dependent on the vaccines and their rollouts going smoothly, which does have the inherent risks of a major logistical undertaking.

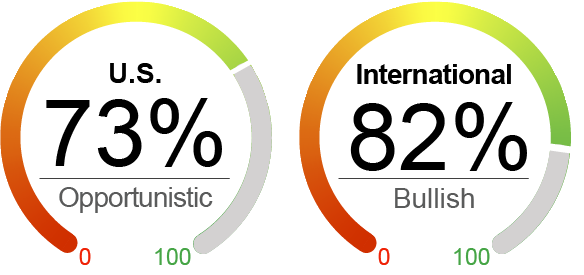

The country as a whole has been very optimistic about the end of 2020 and the start of a new year. Of course, little has changed since last week but there is the expectation that in this year the country will be able to return to normal activity. To achieve that, the rollout will have to move smoothly. We are certainly wary of potential issues with the vaccine distribution and believe there will be some sustained push-pull between rising cases and vaccine distribution in the coming months. Similarly, we expect some back and forth between politics, stimulus and economic activity. We are also aware that much of the optimism surrounding equities is warranted, but that exuberance can significantly inflate prices to unsustainable levels. Currently, some investors are seeking a very high level of risk that we do not see as sustainable. The Georgia senate race runoff will have some market implications in the short-term as it determines control of the senate. A democratic victory might cause some investors to worry about tax increases, though chances of hikes seem slim for the time being. We currently sit 73% invested in our U.S. tactical flagship strategy and 82% invested in tactical international strategy.

By the Numbers (Year-to-Date)*

U.S. Equities (S&P 500 Index) | 17.8%

International Equities (MSCI ACWI ex-U.S.) | 10.7%

U.S. Bonds (Barclays U.S. Aggregate Bond Index) | 7.5%

Global Bonds (JP Morgan Global Aggregate Bond Index) | 9.2%

The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. equity outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

As of 12/31/2020. Data provided by Bloomberg, RBC, NorthCoast Asset Management.

*Source: Bloomberg, NorthCoast Asset Management.

|

Negative Indicator |

Neutral Indicator |

Positive Indicator |

Positive Indicator |

|

Valuation With such a strong year for equities, it is easy to ignore that the economy is still recovering from last Spring’s dip in productivity. The gap between equity prices and company earnings is severe. Valuations are still strongly negative in the U.S. |

Sentiment Sentiment improved in December with the passage of another stimulus bill as both investors and consumers appear more optimistic about current and future economic conditions. The University of Michigan consumer sentiment survey jumped higher from November to December, but is still well below Dec 2019. |

Technical Market momentum is currently very positive thanks to so much upward price movement. For the same reason, reversal indicators are slightly red. Still, technical indicators are overwhelmingly positive and the S&P 500 sits significantly above its most common moving averages. |

Macroeconomic Economic figures showed some signs of strength as the year drew to a close. Manufacturing was a bright spot as compared to services, which were hurt by recent lockdown restrictions. The resilience of manufacturing amid increasing lockdowns is a very positive sign moving into 2021.

|

Important Disclosures

The information contained herein has been prepared by NorthCoast Asset Management LLC (“NorthCoast”) on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2021 NorthCoast Asset Management LLC.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF AN INVESTMENT.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.