The Ongoing Need for Caution

The S&P 500 rose 5.6% in July, buoyed by large tech names that rose thanks to positive Q2 earnings reports and guidance. Excluding the largest tech names, both earnings and price action have been mixed for S&P 500 companies. Earnings season has thus far exposed which companies are most exposed to the impacts of the pandemic. The forced digitization of society has pulled technological advancement and adoption forward at a faster pace than under normal circumstances. As a result, technology companies have outperformed and pulled general indexes higher. Public perception of these companies has also accelerated the price growth and contributed to their stocks trading at some of the highest multiples. But still, thanks to these tech giants the S&P 500 and the Dow Jones Industrial Average have logged four consecutive months of gains.

Notably, U.S. equities’ gains are in stark contrast to economic health. Data released in July showed that U.S. GDP fell at a 32.9% annual rate during the second quarter. This is the steepest decline since GDP has been tracked, back to 1947. Consumer spending had been the bellwether of economic growth in recent years, and it dropped significantly during the second quarter. Much of the economic contraction was expected and in fact the drop in GDP growth was less severe than economists’ expectations. However, the recent rise in coronavirus cases in the U.S. has caused increased concerns of lockdown reinstatements and observable decreases in consumer spending in recent weeks. The economy is predicted to turn around during the third quarter, but this recent spike could hamper the recovery. In order to help us monitor economic data as completely as possible, we have integrated several unique data sets in to our review process, including mobility and lockdown data. This gives us a more comprehensive, detailed and real-time impression of conditions. President and CEO Dan Kraninger discussed these in the recent Q2 newsletter, which you can access HERE.

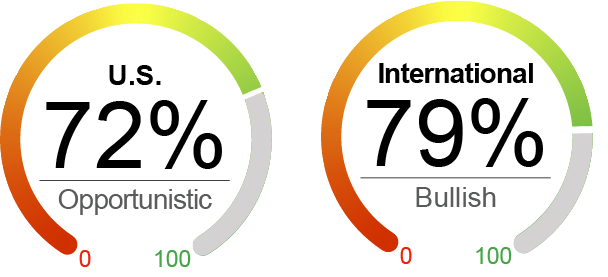

The most immediate matters likely to move the markets are the increasing coronavirus cases and the debate over federal stimulus. Both could negatively impact consumer spending, which has far reaching implications on both the economy overall and individual stocks. Our current investment level points to an opportunistic view of the market. We continue to choose our moves wisely, taking advantage of sudden market shifts to the upside. In recent weeks, generally positive market moves have confirmed our macro view. Our current investment levels remain roughly the same as last month however we continue to view incoming data cautiously. In addition to the immediate risks discussed above, more persistent threats remain such as the upcoming election and tension between the U.S. and China. While we are seeking opportunities for growth, we are equally aware of the ongoing need for caution.

By the Numbers*

U.S. Equities (S&P 500 Index) | 2.0%

International Equities (MSCI ACWI ex-U.S.) | -7.0%

U.S. Bonds (Barclays U.S. Aggregate Bond Index) | 7.7%

Global Bonds (JP Morgan Global Aggregate Bond Index) | 6.3%

The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. equity outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

As of 7/30/2020. Data provided by Bloomberg, NorthCoast Asset Management.

*Source: Bloomberg, NorthCoast Asset Management.

|

Negative Indicator |

Neutral Indicator |

Positive Indicator |

Neutral Indicator |

|

Valuation Valuations are stretched after four consecutive months of gains for the general market. P/E ratio at the end of July was roughly 25, the highest end of month value all year. Large tech names are more stretched than the broader market. |

Sentiment Consumer sentiment is currently tied to both virus cases and stimulus. Therefore, consumer sentiment worsened in July. Investor sentiment seems bolstered by large tech names but mixed earnings has led to a “wait and see” attitude for the broader market. In all, sentiment indicators improved slightly. |

Technical Technicals continued to improve with July’s positive market action. The relative strength index moved higher in light of stronger positive momentum. The VIX ended the month below 25 for the first time since February, through volatility could pick up in August. |

Macroeconomic While GDP contraction during the second quarter was better than expected, it was the fastest annualized rate of contraction since quarterly growth rate has been recorded. Consumer spending is poised to decrease further if stimulus is delayed and/or virus cases continue to rise. Unemployment and weekly jobless claims remain high. |

Important Disclosures

The information contained herein has been prepared by NorthCoast Asset Management LLC (“NorthCoast”) on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2020 NorthCoast Asset Management LLC.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF AN INVESTMENT.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.