NorthCoast Navigator

December 2014

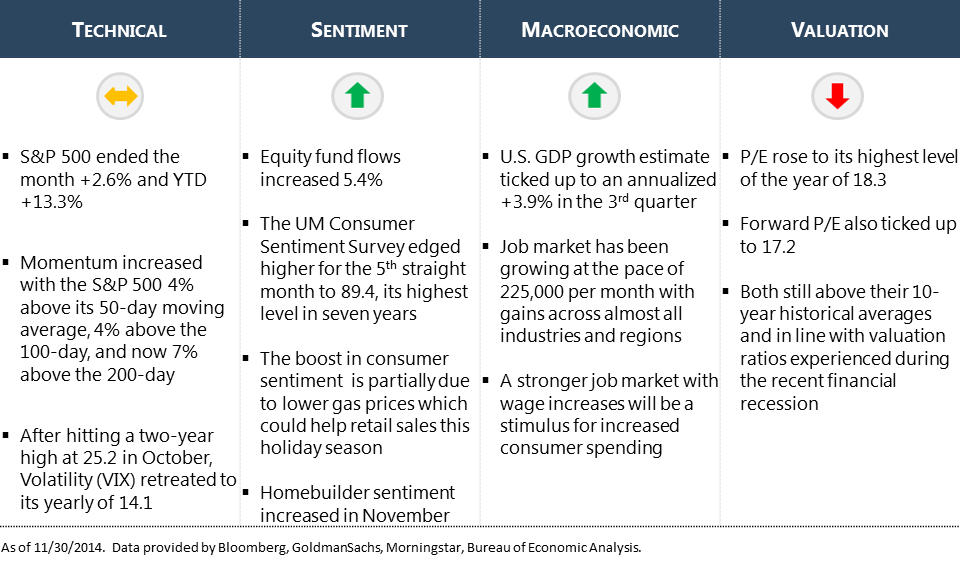

After a volatile October, U.S. equities (S&P 500) steadily rose throughout November to end the month +2.6%. The S&P 500 is +13.3% YTD with one month remaining in 2014. Aside from the valuation concerns, much of our U.S. market analysis remains positive:

Technical: Improving / Sentiment: Positive / Macroeconomic data: Strong / Valuation levels: Weak

Globally, we are witnessing a growing disparity in the economic recoveries and stimulus strategies among the different regions and countries, particularly in the Eurozone and Japan. The Japanese market has seen positive signs after the central bank's decision to expand the quantitative easing program. However, it is important to consider a possible setback given the size of the QE program. Asset purchases in Japan are approaching 60% of GDP; more than double that of its counterparts in the U.S., European Central Bank and the Bank of England.

We enter December between 75%-85% invested in equities across our tactical strategies. In the month ahead, we will pay close attention to momentum and valuation data points. These indicators, along with our fear index, came under pressure and moved lower in November. We will continue to monitor these developments each day and make necessary adjustments when warranted.

The NorthCoast Navigator is a market "barometer" displaying NorthCoast's current equity outlook. This aggregate metric is determined by multiple data points across four broad dimensions including Technical, Sentiment, Macroeconomic, and Valuation indicators. The daily result determines equity exposure in our tactical strategies.