"To think is easy. To act is hard. But the hardest thing in the world is to act in accordance with your thinking" - Johann Wolfgang von Goethe

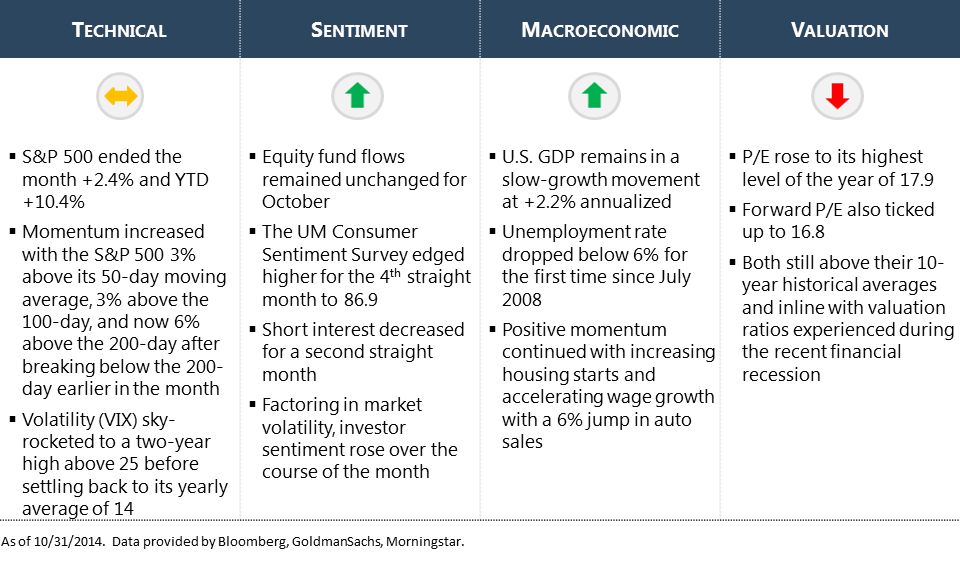

(The NorthCoast Navigator is a market "barometer" displaying NorthCoast's current equity outlook. This aggregate metric is determined by multiple data points across four broad dimensions including Technical, Sentiment, Macroeconomic, and Valuation indicators. The daily result determines equity exposure in our tactical strategies.)

Did you miss the Quarterly Advisor Webinar? On October 14, President & CEO Dan Kraninger led an interactive Webinar recapping Q3 and providing insights into the final quarter of the year. You can listen to the recording by clicking on the question above. Don't have the time for the 30-minute Webinar? Review the PDF Overview here.