The U.S. stock market limped into May as the intra-month rally faded over the final two weeks of April. The S&P 500 ended the month +0.35% and sits +1.53 YTD. The Federal Reserve continued to play a “wait-and-see” game in its decision for another rate hike while commodity prices stabilized and the U.S. dollar weakened. As Q1 earnings season concludes, the results provided no clear answer to the strength of the U.S. economy. From S&P companies reported thus far, almost 80% beat EPS estimates. However, it is worth noting that according to JP Morgan, the actual EPS is down 8% year-over-year for the overall market, as shown in this graph here. The squeeze in EPS growth could be attributed to multiple factors, including an increase in hiring and rising wage growth, which should ultimately put more money back into the pockets of consumers. The real winner of early 2016 is fixed income. In the U.S. and globally, the uncertainty of economic growth and central bank decision-making has kept yields low, therefore increasing return. The U.S. bond aggregate bond index is +3.43% YTD with the global aggregate bond index +6.76% YTD.

The U.S. stock market limped into May as the intra-month rally faded over the final two weeks of April. The S&P 500 ended the month +0.35% and sits +1.53 YTD. The Federal Reserve continued to play a “wait-and-see” game in its decision for another rate hike while commodity prices stabilized and the U.S. dollar weakened. As Q1 earnings season concludes, the results provided no clear answer to the strength of the U.S. economy. From S&P companies reported thus far, almost 80% beat EPS estimates. However, it is worth noting that according to JP Morgan, the actual EPS is down 8% year-over-year for the overall market, as shown in this graph here. The squeeze in EPS growth could be attributed to multiple factors, including an increase in hiring and rising wage growth, which should ultimately put more money back into the pockets of consumers. The real winner of early 2016 is fixed income. In the U.S. and globally, the uncertainty of economic growth and central bank decision-making has kept yields low, therefore increasing return. The U.S. bond aggregate bond index is +3.43% YTD with the global aggregate bond index +6.76% YTD.

Moving into May

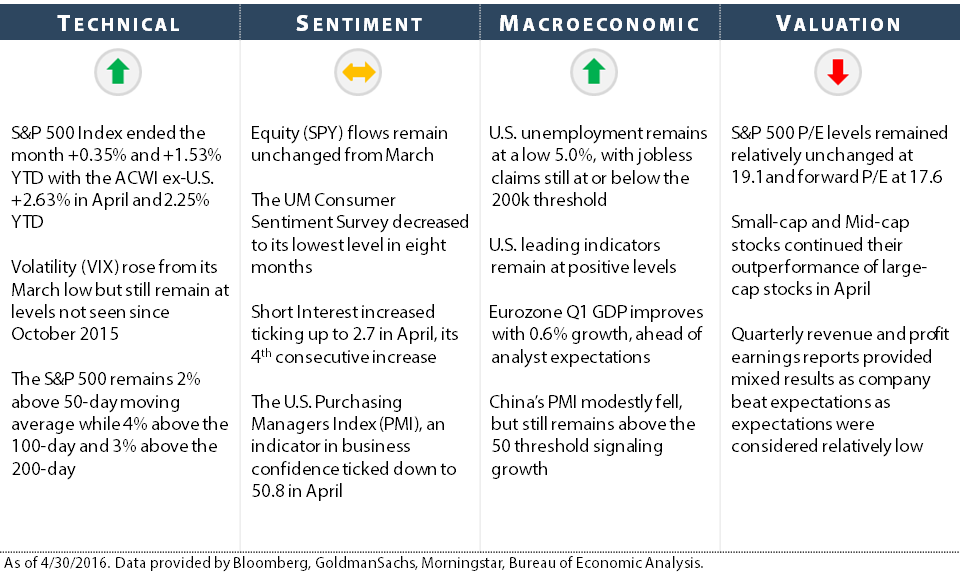

As April progressed, indicators across the four dimensions saw improvement with Technical and Sentiment data points experiencing the biggest boost. In our tactical equities, we added equity exposure amid declining stock prices which provided more attractive entry points. We enter May with 80% equity exposure in our U.S. strategies and over 90% in our international programs.