What happened in August?

What happened in August?

August was a quiet month for global stocks as investors geared up for the fall. U.S. stocks traded inside a tight range with relatively little movement. For the first time this year, the S&P 500 Index did not end a trading session with a move greater than +/- 1.0%. International stocks (ACWI ex-U.S.) fared slightly better, advancing 0.6% in the month.

Corporate earnings surprised to the upside pushing valuations higher in the U.S., while the Eurozone showed its early resilience amid the Brexit aftermath. Continue reading below for additional commentary.

YTD, the S&P 500 Index is +7.3%, while the ACWI ex-U.S. is +4.5%.

Moving into September

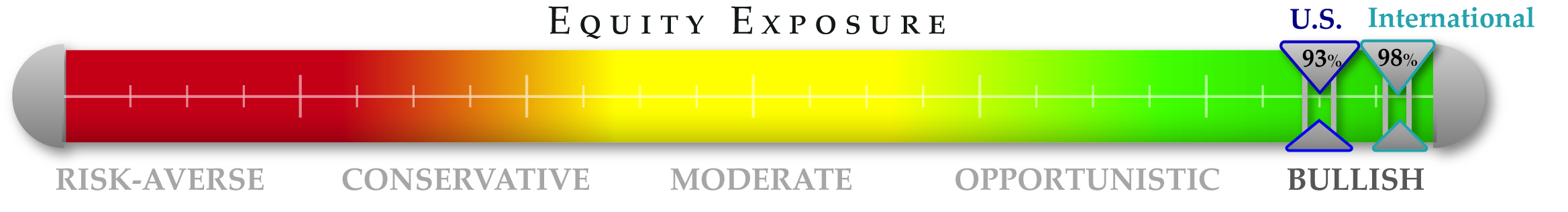

The majority of market-moving indicators remained or turned bullish in August. Ending July with a 75% exposure to U.S. equities, we increased exposure throughout August and entered September 93% invested. In our international strategies, we maintained a bullish posture throughout August and entered September 98% invested.

NorthCoast Navigator

|

Indicators that Improved |

Indicators that Remained Positive |

|

Valuation Even though U.S. stocks valuations are a bit stretched, they present attractive entry when compared against historical averages as well as against today's interest-yielding alternatives.

Technical The S&P 500 Index is 5% above its 200-day moving average and now only 1% above its 50-day, providing a case for near-term positive advances. Volatility (VIX) also ticked up in August.

|

Macroeconomic July stamped the best two-month stretch in hiring for 2016 while the unemployment rate remains low in the U.S. Wage growth matched its strongest annual pace in seven years.

Sentiment Corporate earnings, while diminished, continued to surprise to the upside in Q2. Economists tempered down the fallout of Brexit and consumer sentiment remained at bullish levels. |