A Negative Month, Opportunistic Outlook

The GameStop saga has been inescapable over the last week. While it will likely fizzle out soon enough, it is having an effect on the general market. US equities were down in the final week of January -- some of that due to the uncertainty surrounding what’s been happening with GameStop and other retail investor stock buoys. Institutional investors such as hedge funds who had shorted these stocks have been forced to sell some positions in order to raise cash to cover those shorts. These institutions tend to drive very large volumes in and out of the market, and sales of that size have caused some negative price movement in certain large-cap names. Investors on the outside looking in are concerned about the unexpected volatility and the lack of confidence it causes in the market.

Equities were negative to end January for other reasons. The vaccine rollout in the U.S. has been hitting some logistical snags and supply issues that could impact the speed at which the population is inoculated and the economy recovers. Additionally, many countries including the U.S. are now dealing with outbreaks of newly identified variants of Covid-19. There is some uncertainty about the effectiveness of current vaccines on these new strains. Initial data shows that while the vaccines may be slightly less effective, they should still provide protections especially from severe symptoms. Two additional vaccines from Novavax and Johnson & Johnson finished their late-stage trials in January, and were found to be 89% and 66% effective respectively. Despite J&J’s vaccine being less effective than others at preventing the disease entirely, it did reduce the most severe symptoms.

The U.S. released Q4 2020 economic data in January. Preliminary readings for GDP show growth at an annualized rate of 4.0% during the quarter. Consumer spending slowed relative to Q3, but was still a positive 2.5% annual growth rate. In all, the economy contracted last year and is roughly 3.5% smaller than the year prior, as measured by GDP. That being said, the last two quarters of 2020 were positive for economic growth, and economists are anticipating that the recovery will continue into this year. The main factor this year remains the same as last: how well the pandemic is controlled and how quickly the economy can fully reopen.

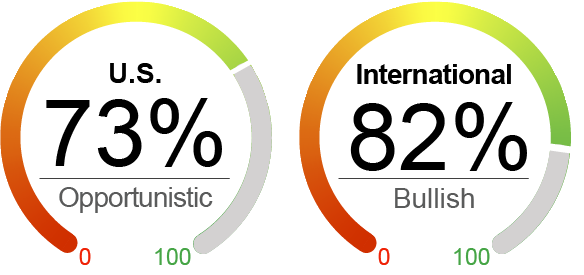

The unexpected market movements have garnered much of the media’s attention, but our focus is more on the economic and earnings data from Q4. If there is any takeaway from the GameStop saga, it is that some areas of the market are overvalued, driven by sentiment. We have been watching valuations as our indicators have been negative and showing some over-exuberance. Coronavirus statistics are also starting to ameliorate concerns in many areas of the country, and discussions of another stimulus bill are resuming in DC. We are 72% invested in U.S. and 83% internationally.

By the Numbers (Year-to-Date)*

U.S. Equities (S&P 500 Index) | -1.0%

International Equities (MSCI ACWI ex-U.S.) | 0.2%

U.S. Bonds (Barclays U.S. Aggregate Bond Index) | -0.7%

Global Bonds (JP Morgan Global Aggregate Bond Index) | -0.9%

The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. equity outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

As of 1/31/2021. Data provided by Bloomberg, NorthCoast Asset Management.

*Source: Bloomberg, WSJ, NorthCoast Asset Management.

|

Negative Indicator |

Neutral Indicator |

Positive Indicator |

Positive Indicator |

|

Valuation Even with some negative price movement, valuations are still stretched. Earnings reports have thus far not been so positive as to justify U.S. equity prices elevated levels. Also, with fixed income yields remaining so low, equities remain a crowded asset class. |

Sentiment Sentiment indicators stayed in line with December. Concerns about the vaccine rollout had some negative impacts but overall, sentiment is much more positive than most of last year. Equity flows were negative in January, but the University of Michigan Consumer Sentiment survey was unchanged. |

Technical Technicals remain positive through last month’s losses. The S&P 500 remains 11% above its 200-day moving average, above the 100-day and roughly even with the 50-day. Volatility did spike last month but settled to roughly the same level as the end of 2020, according to the VIX. |

Macroeconomic The recovery is starting to take the “square-root” shape as GDP growth rate flattened out in Q4 relative to Q3. 2020 was the first economic contraction in the U.S. since the financial crisis, but prospects for 2021 are much more positive. Forecasted GDP growth is between 4% and 5%.

|

Important Disclosures

The information contained herein has been prepared by NorthCoast Asset Management LLC (“NorthCoast”) on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2021 NorthCoast Asset Management LLC.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF AN INVESTMENT.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.