“Keep cool; do not freeze.” Printed on the top of the old metal lids of Hellman’s mayonnaise.

A client of mine for over twenty years shared this anecdote about Hellman’s mayonnaise with me in 1999 and I’ve never forgotten it. He picked it up from his boss at Exxon who would quote it to young managers who were rising up the corporate ladder, and now to me, it seems to perfectly capture my view on the market.

2019 was a really good year. What can an investor complain about -- Dow +25%, S&P 500 +30%, US bonds +9%, Global stocks +21% Global bonds +7%, Gold +19%. Everything appreciated in value. The economy grew, jobs were good, inflation was tame, and the Fed was supportive with three rate cuts during the year. And all of this looks to still be in play as 2020 opens. There is one thing in the back of my mind that bothers me though, which is getting harder to shake – the rise and the impact of the mega cap stocks.

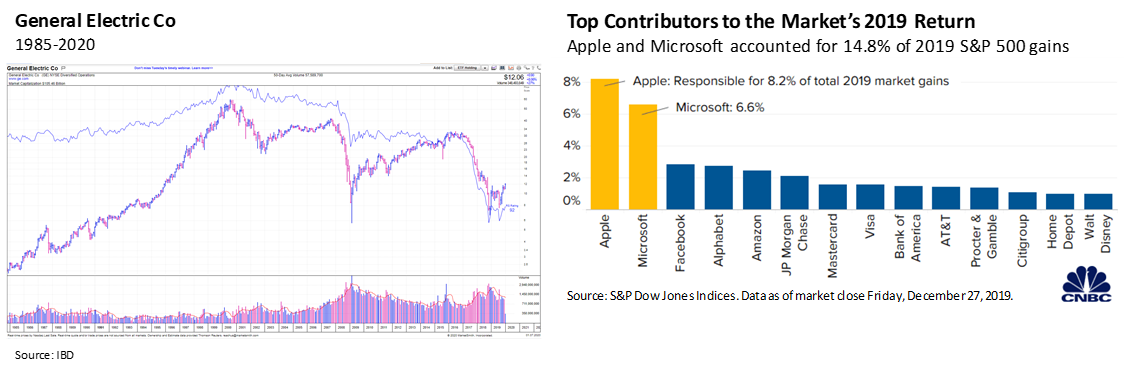

It’s not a coincidence that I chose a story from 20 years ago to start this letter. Why? Because the market’s growth and the concentration of gains among the biggest stocks in the market reminds me a lot of January 2000. In 2000, the big names were Cisco, Intel, GE, and Qualcomm. The price/earnings multiple for the top 10 stocks in 2000 was 62.6! Analysts like Abby Joseph Cohen from Goldman were touting a new era for growth stocks and corporate leaders like Jack Welch were celebrated as investors greeted their companies as the new one-decision stocks (one-decision stock = buy and never sell. Popularized in the 70’s with Xerox and Polaroid before their decline and then afterwards with IBM). Of course, we all know what happened next. The bubble burst in April 2000, ushering in a bear market that bottomed out in 2003 at -49%. Amazingly, even today 20 years later, stocks like Cisco and GE have not returned to their year 2000 high. Cisco is down -11% and GE is down -60% from their respective 2000 highs.

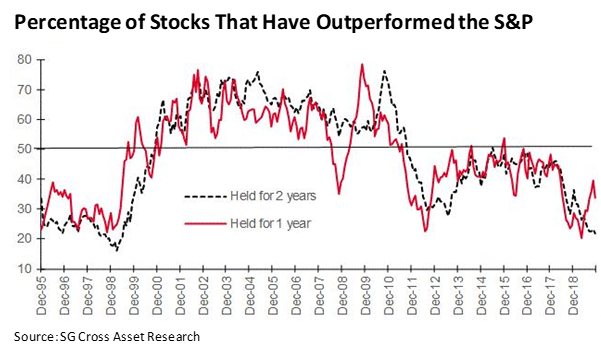

Today, the big names are Apple, Microsoft, Amazon, and Google (a combined market cap over $4 trillion), and the current price/earnings multiple for these four is 42.5. In fact, 15% of the S&P 500’s return this year is attributable to just two stocks, Apple and Microsoft. If their gains were stripped from the Dow Jones, the blue chip index would be nearly 1,100 points lower than its current level. As a money manager, this has made stock picking more challenging because just being big has historically not been an effective factor on which to base a buying decision. In fact, over time small caps tend to outperform. In 2019 though, small caps were beaten by 8 percent by the S&P 500. Other productive factors such as profit margin, earnings growth, and return on equity which have been historically good signals to buy a stock have similarly underwhelmed. Consider Apple - did you know the company earned $11.91 a share in 2018 and has earned less in 2019 at $11.89 a share? Yet during that time, the stock appreciated 85%. Its P/E multiple grew from 13 to its current 25 all while making 2 cents less a share. So long story short, this narrow market and more money being invested in passive ETFs and Index mutual funds is concerning.

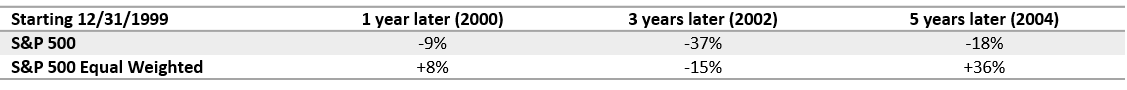

Just because there are some crosswinds though doesn’t mean too much in my mind. As the quote suggests, we will simply be cool and not freeze. After all, 2000-2002 was one of our brightest accomplishments as a firm – while the market sank -49% those three years, we were -5% in our tactical equity strategy. I believe we have the right two models to again do well navigating 2020 forward. First, regarding stock picking, we will continue to identify and invest in stocks that exhibit multifactor strength. Yes the last three years have been an amazing mega cap success but if the market has taught us anything over time it is that fads burn up and burn out. While the big cap S&P 500 dominated in 2019 just as it did in the run up to 1999, what happened after 1999?

The only difference between the two lines in the above table is that in the S&P 500 Equal Weighted each stock contributes 1/500 of the return. It’s simply an average of 500 stocks together. The standard S&P 500 is cap-weighted which means the biggest stocks (AAPL, MSFT, etc.) can have as much as 5% influence because they’re so big. Again, in our research, just because a stock is big is not a reason to expect longer term outperformance.

Second, I believe our cash scaling strategy will continue to pay dividends. We are near 1/3 in cash right now as valuation indicators are negative and the macro-economic signals have weakened. What is strong right now? Technicals. Or said another way, prices are up. So we respect the market’s strength and are 2/3 equities exposed. As always, we will continue to measure the combination of these signals and report to you in our monthly Navigator how they are changing. In 2000-2002, there were times we held over 50% cash to hedge that market and I suspect there may be some times like that ahead in the next three years.

So to summarize, we come back to the advice I received long ago: keep cool, but don’t freeze. Advice that is as good today as it was when a German immigrant, Richard Hellmann, began selling his wife's mayonnaise at his New York deli in 1905.

As always, thank you for your business, and best wishes for a happy, healthy and prosperous New Year.

Sincerely,

Dan Kraninger

President & CEO