A K-Shaped Recovery

The US equities market logged a strongly positive month with general market indexes hitting all-time highs in August. These milestones come after five consecutive positive months for all three U.S. market indexes, a run that would have seemed unthinkable in March. The Federal Reserve signaling low interest rates for the foreseeable future and progress on the COVID-19 vaccine front sowed optimism in August. Once again, the technology sector outpaced the general market, and travel & leisure stocks also logged gains in August, though they generally remain negative for the year.

The shape of the U.S. economic recovery has been discussed since lockdown measures have ebbed and flowed around the country. At this time, consensus is that the recovery is taking on a k-shape. What this means is that there is a divergence, similar to the right half of a “K.” Tech, large-cap and white-collar companies are benefiting from the “new normal” of accelerated adoption of technology in the workplace, education and consumer spending. While cyclicals, small and blue-collar companies are suffering from an inability to adapt quickly enough or an inherent inability to rely on technology to conduct business. U.S. equities are showing a similar divergence, which we have discussed at length, as large-cap and tech companies have shot higher and dragged the general market up while smaller-caps and non-tech companies lag. Expectations are that the k-shape will converge at some point, as the “new normal” economy is unsustainable and those companies that have suffered from the pandemic will recover as the medical crisis improves. At the same time, those companies that have benefited could see some headwinds for the same reasons: workers, consumers and educators relying less heavily on technology.

The next question is then, where are we in the pandemic? The daily cases reported in the US is still high, but some data points are improving. The majority of U.S. states currently have a transmission rate below 1, which implies a downward trend. There is also optimism regarding vaccines as a number of front-runners continue through testing phases. It should be noted that many vaccines do not make it through all testing phases and the timelines can be slow even when accelerated. A full convergence of this recovery may be some time in the future, but we are already seeing and expecting more of the negatively affected companies regaining strength.

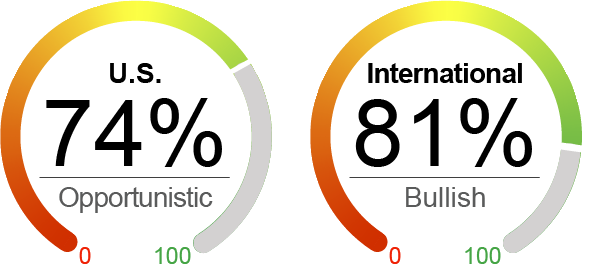

The presidential election is already holding the attention of many investors and will continue to do so as we move closer to November. Volatility is likely to increase as the election nears. Futures are currently pointing to higher volatility in November than the average election year, based on CBOE VIX futures. We added slightly to both U.S. and international equity exposure in August while cycling into some names showing accelerated recovery. We are still seeing more attractive valuations and stability of the medical crisis internationally, particularly in the Eurozone.

By the Numbers*

U.S. Equities (S&P 500 Index) | 9.3%

International Equities (MSCI ACWI ex-U.S.) | -3.1%

U.S. Bonds (Barclays U.S. Aggregate Bond Index) | 6.9%

Global Bonds (JP Morgan Global Aggregate Bond Index) | 6.1%

The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. equity outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

As of 8/30/2020. Data provided by Bloomberg, NorthCoast Asset Management.

*Source: Bloomberg, NorthCoast Asset Management.

|

Negative Indicator |

Neutral Indicator |

Positive Indicator |

Neutral Indicator |

|

Valuation After the better than expected earnings season and favorable monetary policy, among other factors, equities advanced further and valuations remain stretched. International equity valuations are still more attractive than U.S. equities. |

Sentiment Sentiment indicators improved slightly from last month with marginal improvements in the Purchasing Manager Index and the University of Michigan Consumer Sentiment survey. |

Technical Technicals improved after August’s equity gains. The S&P 500 moved to all-time highs and further above its moving averages. Momentum is also positive with the Relative Strength Index jumping to 66 from 58. |

Macroeconomic The economy continues to show some signs of gradual recovery with fewer jobless claims at the end of August, but unemployment remains historically high. Fiscal stimulus was patched, if not haphazardly, while Congress debates a formal plan. There could be economic headwinds if legislation is delayed or remains vague. |

Important Disclosures

The information contained herein has been prepared by NorthCoast Asset Management LLC (“NorthCoast”) on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2020 NorthCoast Asset Management LLC.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF AN INVESTMENT.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.