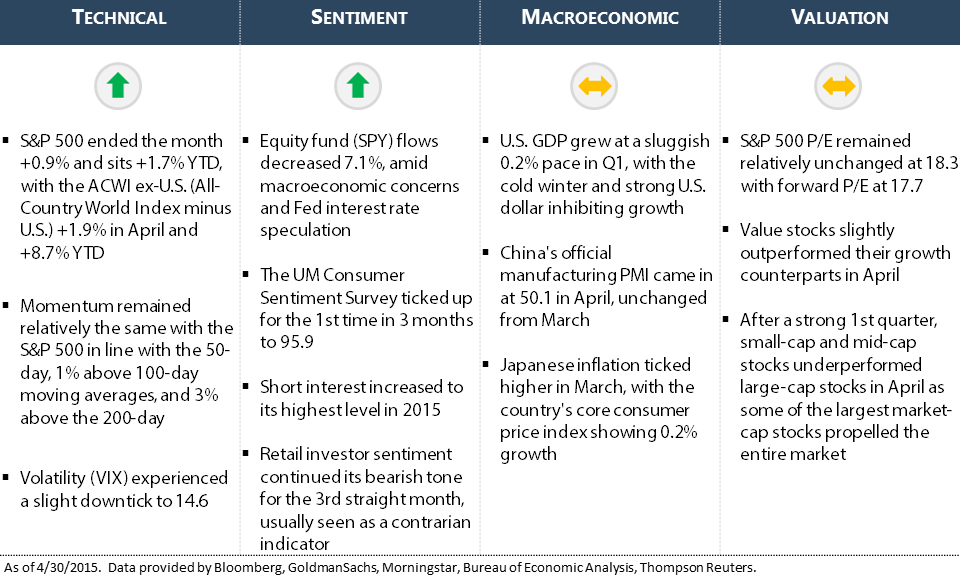

Equities (S&P 500) softened over the recent week and capped off the month with a -1% drop on the last trading day. The S&P 500 now sits +1.7% YTD with international stocks (ACWI ex-U.S.) leading the charge at +8.7%.

Sideways trading persisted in April with slight upward action as consecutive positive sessions were pared with sell-offs, and vice versa. With earnings season approaching its midway point, company profits have surprised more to the upside for the first time in almost 6 years. According to Reuters, “seventy percent of S&P 500 companies are beating analysts' expectations for earnings so far, while just 44 percent are surpassing revenue forecasts.“ Apple (AAPL), the largest company by market-cap share, was a big reason for the positive results.

Other macroeconomic data has recently softened, providing caution in our investment levels across our tactical strategies. The economy grew at a slow 0.2% pace in the 1st quarter, in part because of the cold winter dampening retail sales and a strong U.S. dollar. Across the globe, international stocks posted positive figures as Japan continued its massive stimulus package and data signaling the Eurozone might be pulling out of deflation.

Heading into May, our tactical strategies remain between 72%-96% invested, as mixed data is providing opportunities and caution across global equities. We will closely monitor macroeconomic data along with the second half of earnings season and the Federal Reserve’s decision to eventually raise interest rates. Should the data warrant a change in our exposure or specific positions, we will act accordingly.