What happened in September?

August by the numbers:

U.S. Equities | S&P 500: +0.5%

International Equities | ACWI ex-U.S.: +0.5%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: -0.6%

Global Bonds | JP Morgan Global Aggregate Bond Index: -0.8%

Moving into October

The strong quarterly returns for U.S. equities is a sign that investors are prioritizing the solid corporate earnings and positive economic data over global trade tensions. Lagging international stocks is likely driving some investors to increase their allocation to domestic equities, which may be driving up stock prices even more. As a result, the upcoming U.S. earnings season will be watched very closely. The dollar strengthening during Q3 could have a negative impact on multinationals' profits as it becomes more expensive to convert international profits into U.S. dollars. Upcoming economic and earnings data overseas will also be important to either reinforce the thoughts of an international slowdown or to show some signs of positive growth.

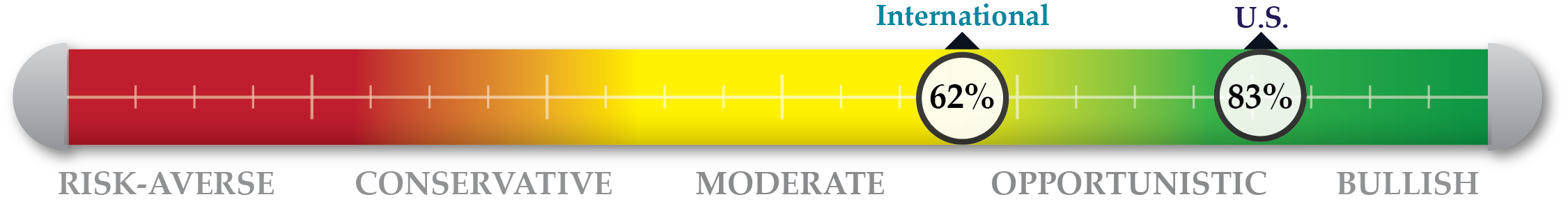

NorthCoast Navigator

|

Negative Indicators |

Neutral Indicators |

Positive Indicators |

|

|

Valuation Valuation indicators remained relatively unchanged from August. S&P 500 P/E ratio sits at 21.1, which is slightly higher than the lagging international markets. |

Technical Technical indicators dropped slightly but remain positive. The relative strength index, a measure of momentum, moved to 58.4 from 62.6. The S&P 500 remains above its 50-, 100- and 200-day moving averages. |

Sentiment Domestic optimism remains as the U of Michigan Consumer Sentiment Index stayed near its multi-year highs. Consumer confidence hit an 18-year high according to Conference Board

|

Macroeconomic Consumer spending growth cooled slightly in August but is still high and forecasted to pick up the pace of growth into the end of 2018. U.S. unemployment remained below 4%. |