Cautiously Bullish Outlook Despite Fed Hawkish Surprise

The stock market posted another positive month in June with the tech-heavy Nasdaq outperforming the market by gaining 5.5% while little changed with the cyclical-heavy Dow. The S&P 500 advanced 2.3% in June with YTD return of 15.0%. The technology sector came in as the top performer, followed by energy, communication services and real estate while financial and material sectors lagged. Overall, a decrease in the long-term bond yields (the benchmark 10-year yield dropping below 1.5%) favored growth stocks by reducing the implied discount rate on future earnings. Lower yields coupled with a flattening of yield curve weighed on financials by threatening bank lending margins as banks tend to profit from larger spreads between short-and long-term rates. The energy sector benefited as crude oil increased by more than 20% in the second quarter driven by supply discipline, growing demand and upward travel trends.

A surprisingly hawkish outcome from the Fed Reserve’s June policy meeting unleashed massive immediate repositioning in the financial market, but did not change our cautiously bullish market outlook. Thirteen of eighteen Fed officials see the first rate hike occurring by the end of 2023. The dot plot now shows two rate hikes in 2023, but it’s not clear how aggressive this tightening cycle will be, as it depends on how much of an inflation overshoot the Fed will allow. Given the recent mixed labor market data and the unemployment rate still as high as 5.8%, we don’t expect the Fed to announce its tapering until September and think the actual tapering might not start until 2022. We believe one of the following scenarios is likely to occur:

-

Our baseline scenario of gradual policy normalization together with transitory inflation and solid economic recovery leading to moderate yet positive equity return.

-

In a riskier scenario of persistent inflation coming together with strong growth, equities should still do relatively well, although with the possibility of higher volatility.

-

A third scenario of stagflation, characterized by slow growth/high unemployment and high inflation, would be harmful for the market. However, we believe that the probability of this worst case scenario is low.

The recent data confirms that the economic recovery is still in good shape. The ISM manufacturing index continued to increase, and the consumer confidence index rocketed more than expected to the highest level since February 2020 as consumers' concerns over inflation eased and spending plans picked up. Labor market data was mixed with payroll gains falling somewhat below expectations and weekly jobless claims remaining well above the pre-pandemic average. The lackluster employment data, however, helped to calm market fears about an overheating economy and potentially persistent inflation.

Moving forward, we believe the firming economic backdrop, more synchronized global recovery, strong consumer spending outlook and another batch of strong corporate earnings should support further equity upside. Volatility is also expected down the road with the key sources of uncertainty including inflation fear, tax policy concerns and the market’s sensitivity to the Fed policy.

By the Numbers (Year-to-Date)*

U.S. Equities (S&P 500 Index) | 15.0%

International Equities (MSCI ACWI ex-U.S.) | 9.2%

U.S. Bonds (Barclays U.S. Aggregate Bond Index) | -1.6%

Global Bonds (JP Morgan Global Aggregate Bond Index) | -3.2%

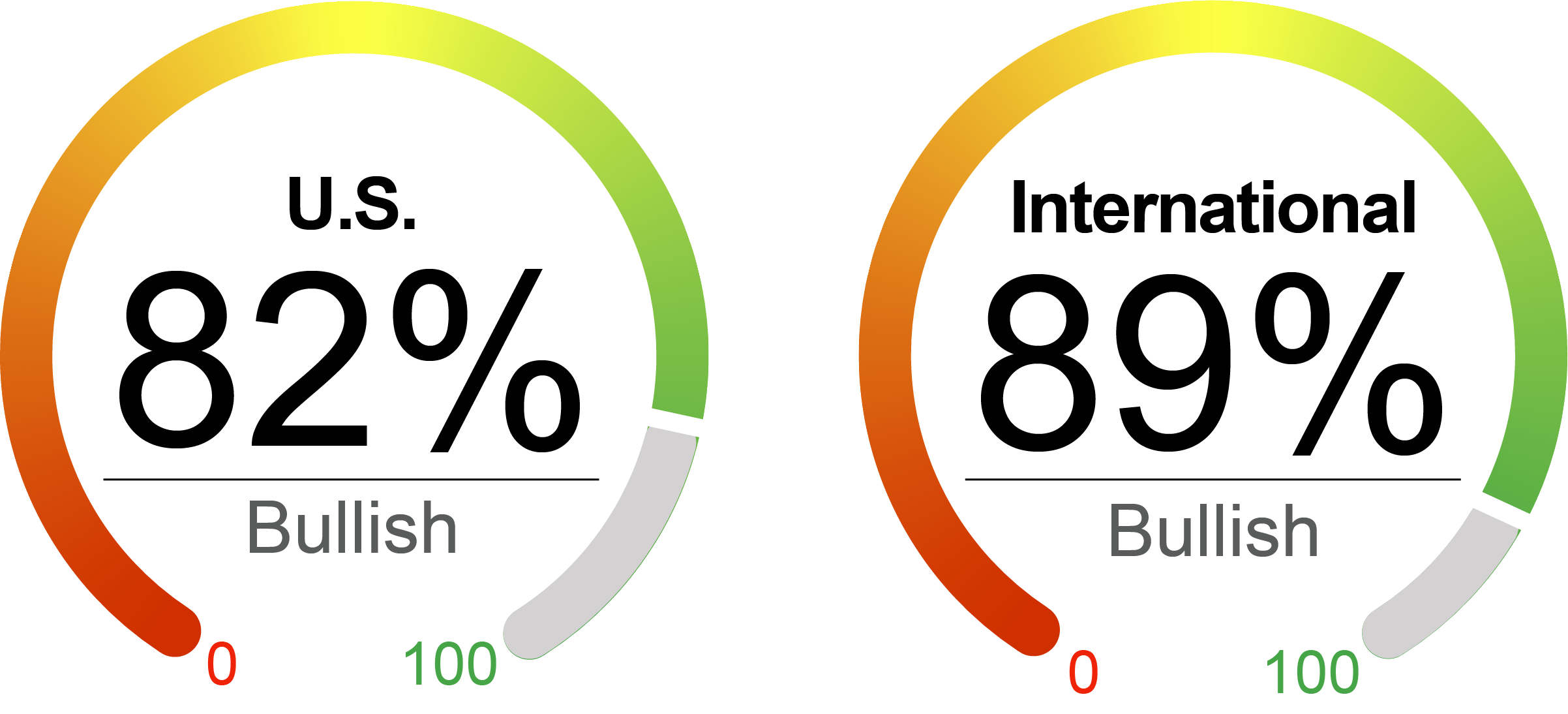

The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. equity outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

As of 6/30/2021. Data provided by Bloomberg, NorthCoast Asset Management.

*Source: Bloomberg, WSJ, NorthCoast Asset Management.

|

Negative Indicator |

Neutral Indicator |

Positive Indicator |

Positive Indicator |

|

Valuation With the market hovering around a record high and the S&P500 index increasing by about 15.0% for the first half of 2021, valuations for equity are still under pressure. P/E ratios increased to 30.4 at the end of June from 29.8 at the end of May. Forward P/E ratio also increased slightly to 22.7. Inflation adjusted valuation metrics continued to be negative with inflation rising. |

Sentiment Consumer sentiment rebounded in June, according to both the University of Michigan’s report and the Conference Board Index. Confidence continued to be supported by the rapid rollout of vaccinations, seemingly plentiful job openings and growing consumer wealth. The PMI index increased to 61.2 in May, with manufacturers weathering the rise in commodity price reasonably well. |

Technical Technical indicators remained positive but look stretched. At the end of June, the S&P 500 was 12% above its 200-day moving average, 5% above the 100-day average and 2% above the 50-day average. Volatility spiked in the mid of the month with the hawkish surprise from the Fed meeting, but came down and settled at 15.8, compared with 16.8 at the end of last month. |

Macroeconomic Labor market data was mixed with payroll increasing by 559,000 but weekly jobless claims remaining above 400,000. Despite the abundance of available jobs, the bumpy recovery could be partially explained by temporary labor supply issues including inability to work because of childcare, fear of illness, aging workforce, and generous unemployment insurance benefits. Industrial production rose 0.8%. Inflation has accelerated but we view the factors driving the recent price surge as transitory.

|

Important Disclosures

The information contained herein has been prepared by NorthCoast Asset Management LLC (“NorthCoast”) on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2021 NorthCoast Asset Management LLC.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF AN INVESTMENT.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.