Current Equity Exposure |

|

|

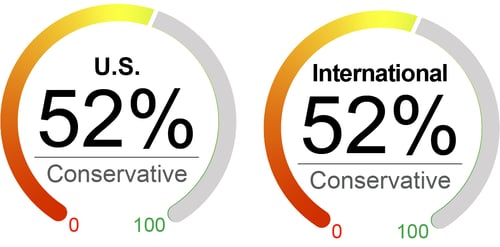

Major equity indexes ended the month of March higher: the S&P 500 and the Dow gained 3.7% and 2.1%, respectively, while the technology-heavy Nasdaq advanced 6.8%. However, the ride hasn’t been a smooth one as the month began with turmoil in the banking sector. Although it’s still too early to have a clear view of the current financial sector stress implications, we believe that the recent events may lead to further tightening in bank lending standards and a pullback in credit availability that could prove to be a headwind for economic activity. At the same time, we expect central banks to come closer to the end of rate hikes, while keeping interest rates high to fight high inflation. We stay underweight equities as we believe the risks remain skewed toward the downside but are nonetheless ready to seize opportunities as risks become priced into the market. We utilized the sharp equity selloff as an opportunity to slightly increase our equity exposure to 52% for both the U.S. and international markets. |

The Factors |

|

Valuation

|

|

Sentiment

|

|

Technical

|

|

Macroeconomic

|

|

What's Driving the Markets?

SVB closure and market implication: While we believe that the SVB closure is unlikely to escalate into a systematic banking crisis, what happened at SVB indicates a more widespread mismatch between bank assets and liabilities. The failures of SVB and Signature Bank might lead to a pullback in credit growth in the economy, which can be a meaningful headwind to overall economic growth. Banks with less than $250bn in assets accounted for 70% of loan growth last year and 80% of the outstanding commercial real estate bank loans, indicating the impact that recent bank failures may have on the economic landscape. At the same time, we believe that large banks (compared with smaller banks) are better positioned with greater liquidity, heightened risk management, more regulatory oversight, and better diversification.

Fed near the end of the hiking cycle: The FOMC increased the target range for the fed funds rate by another 25 basis points to 4.75% to 5% in its March meeting to continue its attempts to tame stubbornly high inflation amid turbulence in the banking sector. We believe that we are now closer to the end of the rate hiking cycle. The Fed’s statement replaced its previous statement, “ongoing increases in the target range will likely be appropriate” with “some additional policy firming may be appropriate” – taken by the market as a dovish shift. Also, we believe the recent development in the banking sector is likely to result in tighter credit conditions, which would work to slow economic growth and eventually affect inflation. As a result, the Fed might need to do less tightening for its monetary policy.

Inflation: mixed signals: The February inflation sent some mixed messages, with the headline index decelerating (from 0.5% in January to 0.4% in February) but the core index rising more than anticipated (from 0.4% to 0.5%). Tight labor markets have kept wage inflation high. However, as the market rents already decelerated significantly in 2022, we expect the shelter and rental inflation (43% of core CPI) to moderate meaningfully later this year, which will be a key source of core disinflation (the rent growth shows up in the CPI calculation with a lag).

|

|

As of 3/31/23. Data provided by Bloomberg, NorthCoast Asset Management, Federal Reserve History. 1 The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. and international equity exposure and outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

NorthCoast Asset Management is a d/b/a of, and investment advisory services are offered through, Connectus Wealth, LLC, an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Connectus can be found at www.connectuswealth.com.

NorthCoast and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

The information contained herein has been prepared by NorthCoast Asset Management ("NorthCoast") on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2022 NorthCoast Asset Management.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF THE INVESTOR'S PRINCIPAL.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.

|