Current Equity Exposure |

|

|

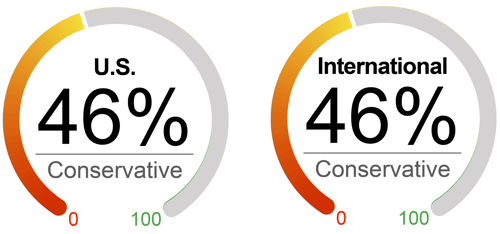

All three major U.S. equity indexes ended lower in February as investors weighed some resilient economic data against fears that inflation might not decelerate quickly, and the Fed would likely raise the fed funds rate higher than expected. We maintain our view that the equity risk/reward outlook is skewed to the downside, with persistent inflation, monetary policy uncertainty, mounting margin pressures, and potential geopolitical risks. We remain underweight in equities but are utilizing the current downturn as an opportunity to slightly increase our U.S. equity exposure from 40% to 46%. We increased our international equity exposure from 37% to 46%, reflecting better valuations, improved growth outlooks, and tailwinds from China reopening. |

The Factors |

|

Valuation

|

|

Sentiment

|

|

Technical

|

|

Macroeconomic

|

|

What's Driving the Markets?

International Equity Markets: We believe that international equity markets, including the eurozone, Japan, and emerging markets could offer opportunities for better risk-adjusted rewards. Given the fast decline in energy prices, higher confidence indices, and better-than-expected real GDP growth, we now see an improved growth outlook for the eurozone area. We also anticipate a relatively positive environment for emerging markets equities as China reopens and emerging market central banks are ahead of developed market peers in policy tightening. Furthermore, the slowing pace and a later pause of the Fed’s rate hikes would likely spur a further depreciation of the US dollar, thus helping international assets. International equity valuations remain more attractive, with the US trading at a P/E of 19, compared to the Eurozone and Japan at around 13 and emerging markets at 11.

Persistent inflation: January inflation readings surprised to the upside and suggested inflation is not declining as smoothly as some investors had anticipated. The consumer price index and producers price index rose 0.5% and 0.7% in January, respectively, both higher than expected. Our view remains that inflation will moderate further this year but will likely settle closer to 3% (versus the Fed’s 2% target). One silver lining is that rental inflation (outsize weight in the CPI) will likely decelerate in mid-2023, given that rent growth shows up in the CPI calculation with a lag.

The Fed Funds Rate – Higher for Longer: The Federal Open Market Committee announced a 25-basis point increase to the target range of the federal funds rate, bringing the target range to 4.5% to 4.75%. The minutes of the February FOMC meeting noted that all participants continued to anticipate that “ongoing” rate increases would be appropriate going forward. The Fed’s messaging has skewed more hawkish during the month, sending signals that the fight against inflation could require more tightening. In our view, the stubbornly high inflation, and recent resilient economic data pose upside risks to the terminal rate.

Corporate Earnings: As of 02/24/2023, among the 94% of S&P 500 companies that have reported Q4 2022 earnings, 68% of them have reported a positive EPS surprise, and 66% have reported a positive revenue surprise. However, the blended earnings decline for the S&P 500 is -4.8%. The breadth of companies struggling with margin pressures is high, with slowing sales, elevated input costs, and high wages.

|

|

As of 2/28/23. Data provided by Bloomberg, NorthCoast Asset Management, Federal Reserve History. 1 The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. and international equity exposure and outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

NorthCoast Asset Management is a d/b/a of, and investment advisory services are offered through, Connectus Wealth, LLC, an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. More information about Connectus can be found at www.connectuswealth.com.

NorthCoast and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

The information contained herein has been prepared by NorthCoast Asset Management ("NorthCoast") on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2022 NorthCoast Asset Management.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF THE INVESTOR'S PRINCIPAL.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.

|