An Uneasy and Uneven Recovery

An anemic gain in June capped off the S&P 500’s best quarter in over 20 years, rising roughly 20% over the 3 month period. Much of this past quarter’s gains were logged in April and May when federal stimulus packages were announced and the Federal Reserve pledged to provide liquidity to credit markets and other asset classes. June’s gains were stymied by a recent increase in Coronavirus cases, specifically in the Southern and Western U.S., which has caused delays in economic reopening plans. Additionally, it has become clearer that both manufacturing and consumer spending are recovering at a slow pace.

The recent spike in cases across parts of the U.S. has led to some hesitation in economic reopening plans and increased uncertainty regarding the recovery timeline. Similar to the beginning of this health crisis, the focus is again on infection data. The difference at this stage is that the state-level data has become more important, making it more apparent that the reopening will vary by region as opposed to sweeping across the country as a whole. The likely effect on the U.S. economy will be an increasingly uneven recovery. For equities, the high level of uncertainty regarding the Coronavirus and economic stability can both be expected to contribute to elevated volatility. While we anticipate the U.S. election to gain attention during the 3rd quarter, the reopening of the economy will be the overwhelming focus in the near-term.

Two interesting phenomena became more pronounced throughout the second quarter. The first was the reluctance by companies and analysts to provide guidance. In fact, roughly 40% of companies in the S&P 500 have withdrawn their guidance due to the uncertainties surrounding the Coronavirus crisis. The second was the increase of individual investors in the market who continue to fiscally support companies most affected by the health emergency. The stock prices of cruise lines and other tourism or travel-driven companies have benefited from a flow of investor funds.

We increased our U.S. equity exposure during the month of June as we saw an improvement in both technical and sentiment indicators. However, we remain cautious due to pauses in reopening and the concerns and uncertainty they raise. We anticipate some short-term volatility resulting from Q2 earnings announcements and increased volatility in the longer-term until some of these uncertainties are resolved.

By the Numbers*

U.S. Equities (S&P 500 Index) | -3.4%

International Equities (MSCI ACWI ex-U.S.) | -11.0%

U.S. Bonds (Barclays U.S. Aggregate Bond Index) | 6.1%

Global Bonds (JP Morgan Global Aggregate Bond Index) | 3.0%

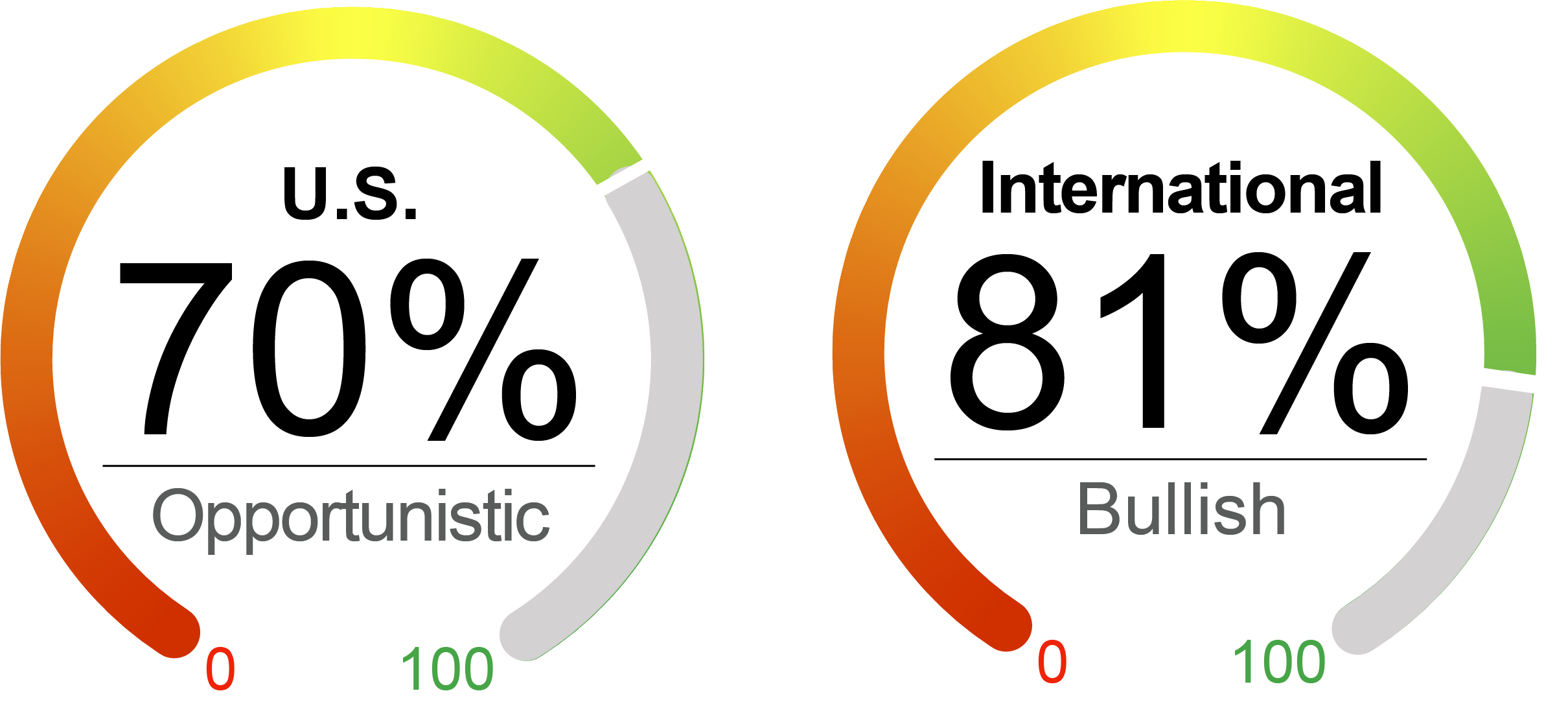

The NorthCoast Navigator is a market barometer displaying NorthCoast's current U.S. equity outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

As of 6/30/2020. Data provided by Bloomberg, NorthCoast Asset Management.

*Source: Bloomberg, NorthCoast Asset Management.

|

Negative Indicator |

Neutral Indicator |

Neutral Indicator |

Negative Indicator |

|

Valuation There was little change in valuation indicators during the month of June. Some sectors are becoming more stretched than others even as guidance is being pulled, specifically technology. P/E ratios sit at 22.0 as of 6/30. |

Sentiment Though still low, our measures of sentiment moved slightly higher during June. The University of Michigan sentiment survey ticked up to 78 from 72, and mutual fund outflows slowed slightly. However, investor sentiment remained low. |

Technical With only a small overall gain in the month of June, technicals remained in line with last month. Volatility, as measured by the VIX, is still high and we did see some large intra-month daily moves. We expect volatility to continue well into the third quarter. |

Macroeconomic Consumer spending increased marginally during May according to data released in late June. Despite the increase, spending remains down roughly 12% from February. Unemployment is still at a record high and it remains to be seen how much of the job loss will be permanent. |

Important Disclosures

The information contained herein has been prepared by NorthCoast Asset Management LLC (“NorthCoast”) on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2020 NorthCoast Asset Management LLC.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF AN INVESTMENT.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.