What happened in August?

What happened in August?

August by the numbers:

U.S. Equities | S&P 500: -1.7%

International Equities | ACWI ex-U.S.: -3.1%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: 2.6%

Global Bonds | JP Morgan Global Aggregate Bond Index: 2.4%

Moving into September

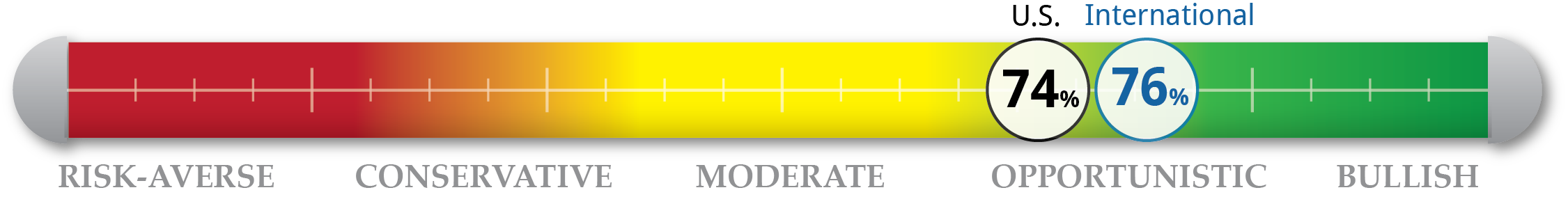

The inversion of the yield curve continued to deepen as the price of longer-dated 10-year treasury notes was driven up by increased demand. The Federal Reserve’s actions in the coming months could reduce the inversion if they decide to lower short-term interest rates. It is important to remember that an inverted yield curve is only one of many indicators used to try to foresee a recession. At the moment, unemployment is still low, consumers are still spending and GDP is growing. The U.S. and China continue to spin the broken record of increasing tariffs and leveraging the media to dial up pressure. Any news about this trade deal will impact global markets and meetings are scheduled for early September. The investment level remains relatively unchanged in our tactical U.S. strategy. A drawback in technical and sentiment indicators of international equities as well as uncertainty surrounding trade led to lower exposure in our international tactical strategy.

|

|

|

|

|

|

Valuation Due to the slight downturn in U.S. equities, P/E ratios were marginally reduced from July’s levels although remain high. With moderate growth in earnings along with the current market uptrend, P/E ratios still sit at 19.2. |

Sentiment Despite strong consumer spending, consumer confidence indicators showed some weakness in August. Uncertainty surrounding global trade appears to be impacting consumers’ outlook. The University of Michigan Consumer sentiment Survey dipped to 89.8 from 98.4. |

Macroeconomic Concerns that plagued equity markets in August have yet to show much of a tangible impact on macroeconomic indicators. GDP growth in the second quarter was solid despite coming in below the prior two quarters. Corporate profits grew quarter-over-quarter and consumer spending is still high. Unemployment remains largely unchanged and historically low. |

Technical Due to the large amount of volatility in August, shorter-term technical indicators experienced a drawback. The S&P 500 dipped below its 50-day moving average and moved closer to its 100- and 200-day averages. Longer-term technical indicators, however, were positive as well as the relative strength indicator of momentum and reversal indicator. |