What happened in December?

December by the numbers:

U.S. Equities | S&P 500: -9.0%

International Equities | ACWI ex-U.S.: -4.5%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: 1.8%

Global Bonds | JP Morgan Global Aggregate Bond Index: 1.9%

Moving into January

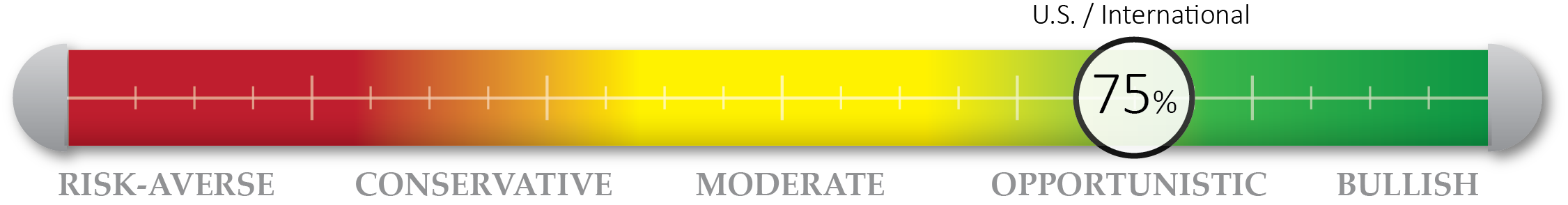

NorthCoast entered December with 30% cash in its U.S. tactical equity strategies and reached a high cash level of 35% after the 1st week of trading. Then as stocks continued to trade negatively with major volatility, we marginally increased our equity exposure throughout the month as valuations became more attractive along with the lack of real economic data warranting a substantial decline. We enter 2019 approximately 75% invested in our U.S. and international tactical equity strategies. We will keep a close eye on any major developments along with key economic data and Q4 earning reports released in the coming weeks. Looking for additional insight? The NorthCoast portfolio management team answered questions regarding global growth, 2019 opportunities and the recent market action. Click to download the Q&A report.

NorthCoast Navigator

|

Negative Indicators |

Neutral Indicators |

|

Positive Indicators |

|

Technical The S&P 500 Index declined through traditional support levels as the 50-day, 100-day and 200-day moving averages are -6%, -9% and -9%, respectively. The VIX (volatility) increased to its highest level in 2018 to 25.4 |

Valuation Equity valuations (S&P 500 P/E multiples) declined to 17.1 with Forward P/E to 15.4, their lowest levels in over a year. Rising interest rates presented competitive opportunities as investors seek higher yield in new bond offerings |

Sentiment Investment flows into U.S. index fund SPY were slightly negative. AAII investor survey (a contrarian indicator) saw a major increase in bear market sentiment, up to 50.3 from 39.5 last month

|

Macroeconomic Unemployment rate remained at multi-year low of 3.7%, while the economy continued to add jobs, +155,000 in November. Industrial production rose 0.6% in November. Wage growth (average hourly earnings) increased 3.1% over the previous year |