What happened in April?

Bolstered by strong corporate earnings reported for the first quarter, the S&P 500 Index experienced a small gain during the month of April. Of the 274 companies in the general market index that reported their first quarter earnings, almost 80% reported above analysts’ expectations. This number is above the long-term average of 64% and the four prior quarters’ average of 72%. Considering these strong numbers, the equity market’s reaction was relatively muted. The limited reaction may have been due to the equity market boost that already occurred in December from the tax overhaul, which somewhat priced in expected strong earnings for Q1. Trade restrictions and rising oil costs are putting pressure on manufacturers who are subsequently pushing some costs to consumers. As a result, inflation ticked higher in March, increasing by 2% from a year earlier according to the Commerce Department’s price index. A 2% rate of inflation is the Federal Reserve’s target and may put more pressure on the central bank to increase interest rates more quickly.

Across the globe, the pan-European index Stoxx Europe 600 gained in April on positive corporate earnings, despite some unfavorable economic news out of Germany and Italy. In the final hours before the deadline, the U.S. extended the implementation of tariffs going into effect on the Eurozone and other U.S. allies to June 1st, much to the relief of these countries.

April by the numbers:

U.S. Euities | S&P 500: +0.4%

International Equities | ACWI ex-U.S.: +1.6%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: -0.7%

Global Bonds | JP Morgan Global Aggregate Bond Index: -1.5%

Moving into May

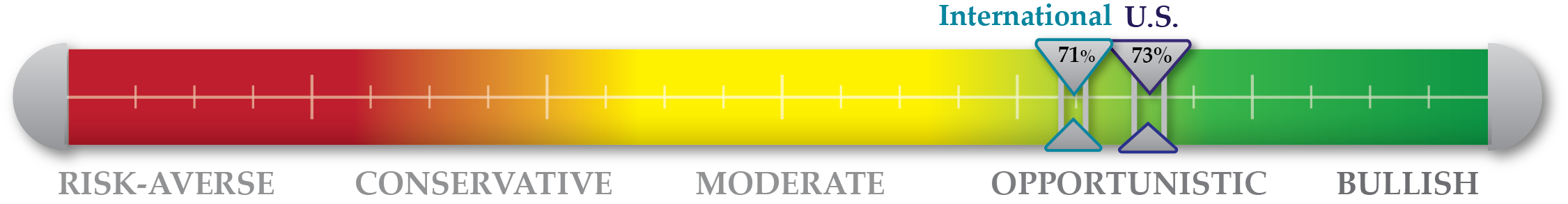

Our market exposure model is currently recognizing elevated levels of risk in the equity market and we are invested accordingly. We are holding roughly 30% of both our domestic and international portfolios in cash. Investors will be watching the Federal Reserve’s meeting that will conclude during the first week of May. Although no major policy change is expected, any indication of their future decisions on rate increases will surely influence the equity markets. The market’s reaction to the final weeks of earnings season will also be of interest, especially if it continues to be limited indicating that investors are more concerned about geopolitical news as well as U.S. trade and monetary policy. We enter May 73% invested in our domestic tactical strategies and 71% invested in our international tactical strategies.

NorthCoast Navigator

|

Negative Indicators |

Neutral Indicators |

|

Negative Indicators |

|

Valuation The S&P 500 was relatively flat for the month of April leading to valuation indicators remaining reasonably stable from March, although still at elevated levels. P/E ratios remained around 21. |

Technical The VIX dropped slightly from the previous two months, moving to 16 from 20. The flat month in April brought the S&P 500 closer to its 200-day moving average. The index now sits just 1% above its long-term average. |

Sentiment The University of Michigan Consumer Sentiment survey ticked lower in April. The Bull/Bear ratio, a contrarian indicator, ticked higher during the month and short interest in the market remained steady. |

Macroeconomic Personal consumption expenditures increased in March after falling slightly in the first two months of the year. Personal income also increased in March. U.S. GDP expanded at an annual rate of 2.3% in the first quarter, down slightly from Q4 2017. |