What happened in November?

November by the numbers:

U.S. Equities | S&P 500: -6.9%

International Equities | ACWI ex-U.S.: -8.1%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: -0.8%

Global Bonds | JP Morgan Global Aggregate Bond Index: -1.2%

Moving into December

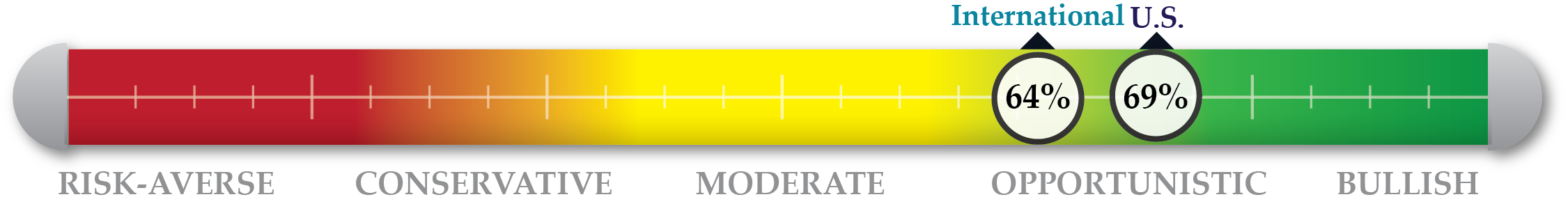

There are likely to be some updates concerning the U.S. and China trade dispute following the G20 summit but a resolution in any form is unlikely to come before the end of the year. News concerning progress or setbacks will certainly move the U.S. and international markets in the short-term. The Federal Reserve policy announcement in December will also shed some light on the current state of the U.S. economy and the central bank’s outlook for additional hikes. We decreased exposure in our domestic and international equity strategies throughout November amidst the volatile market action and uncertain outlook. The strategies sit at approximately 70% invested in a neutral position that we believe to be suited to handle the volatility and take advantage of opportunities as they arise.

NorthCoast Navigator

|

Negative Indicators |

Positive Indicators |

|

|

|

Valuation Equity valuations (S&P 500 P/E multiples) sit at 18.9 after the October selloff and volatile November. While still elevated, this level marks the second lowest reading in over a year |

Technical The S&P 500 moved below its long term averages in October, but tightened closer to them with the uptick in November. The VIX ticked lower from its month-end 2018 high in October and now sits at 18.1. |

Sentiment The University of Michigan Consumer Sentiment Survey remained high. Investment flows into U.S. index fund SPY were slightly positive but show some hesitation from

|

Macroeconomic Driven by rising incomes, U.S. consumer spending increased in October according to data released in November. Inflation appeared in line with the Fed’s 2% target signaling continued solid economic growth |