What happened in February?

The strong start to the year continued in February with a positive month for equities. Relatively upbeat earnings and economic news outweighed continued uncertainty and concerns about slowing global growth.

One of the top stories from the month was the U.S. extending the deadline for increasing tariffs on Chinese goods, possibly signaling that an agreement is near. However, the month came to an end with no firm indication of a conclusion to the negotiations. Additionally, concerns remain that any agreement will not bring an end to the rivalry between the two countries. As negotiations continue, the Chinese manufacturing purchasing manager index dropped to its lowest level in three years – reinforcing some concerns of a global slowdown.

While global growth might be slowing, the U.S. economy appears to be strong. Positive economic data was released last month including the GDP growth rate from Q4 2018 beating estimates, personal income growth and a rebound in business investment. Doubts remain however over the sustainability of the decade-long expansion. The Federal Reserve’s current “patient” stance hints at these concerns.

Internationally, emerging markets had only a slightly positive month after a large rebound in January. The U.K. is still struggling to reach a Brexit agreement and Canadian Prime Minister Justin Trudeau is facing domestic political controversy.

February by the numbers:

U.S. Equities | S&P 500: 3.1%

International Equities | ACWI ex-U.S.: 2.0%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: -0.1%

Global Bonds | JP Morgan Global Aggregate Bond Index: -0.5%

Moving into March

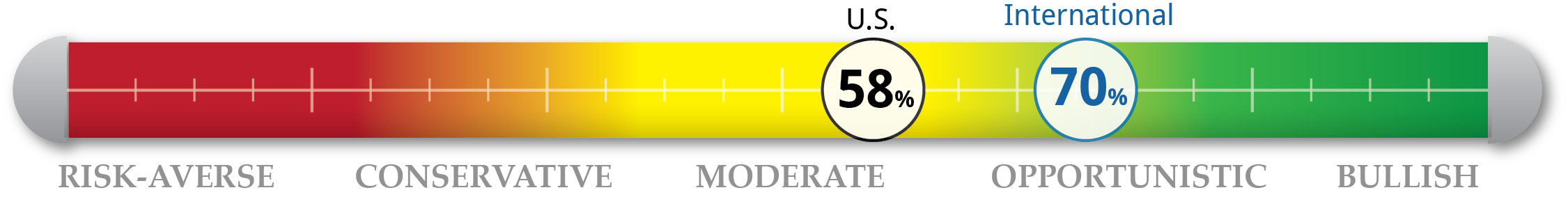

Notable storylines from 2018 continue to be significant now as U.S. – China trade, the U.S. Federal Reserve and Brexit negotiations are still moving markets and important to consider. Our technical and sentiment indicators are still depressed but rebounded slightly since the end of last year. Valuation remains negative after more price gains in equities. Some more nuanced issues to consider moving forward include when corporate tax cuts will officially be flushed out of earnings and if that will lay bare some underlying weaknesses. Tariffs have had a negative impact on the U.S. farming industry, which was already struggling through years of depressed crop prices, and these troubles may spread to other industries if a resolution is not reached. We hold a near-term moderate view of the market and sit 58% and 70% invested in our domestic and international equity strategies, respectively. The last time we held this level of cash in our domestic tactical strategy was in early August of 2012.

NorthCoast Navigator

|

Negative Indicators |

Neutral Indicators |

|

Positive Indicators |

|

Valuation With the rebound in equity prices since the end of 2018, valuation indicators have turned negative once again. P/E ratios rose in February and are once again approaching 20 – companies are more expensive relative to their earnings. |

Technical Positive price movement brought major indexes, the S&P 500 (U.S.) and ACWI Ex-U.S. (international), back above their long-term moving averages. Momentum rebounded a bit in Feb according to the relative strength index. |

Sentiment A slight rebound in sentiment indicators with mutual fund flows turning positive from the prior month and the University of Michigan Consumer Sentiment moving higher to 93.8 after declining in January. |

Macroeconomic Q4 2018 GDP growth rate came in at 2.6%. This capped off one of the strongest year in the current 10-year expansion. Job growth remains strong and, importantly, business investment rebounded. |