What happened in August?

August by the numbers:

U.S. Equities | S&P 500: +3.2%

International Equities | ACWI ex-U.S.: -2.1%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: +0.6%

Global Bonds | JP Morgan Global Aggregate Bond Index: +0.1%

Moving into August

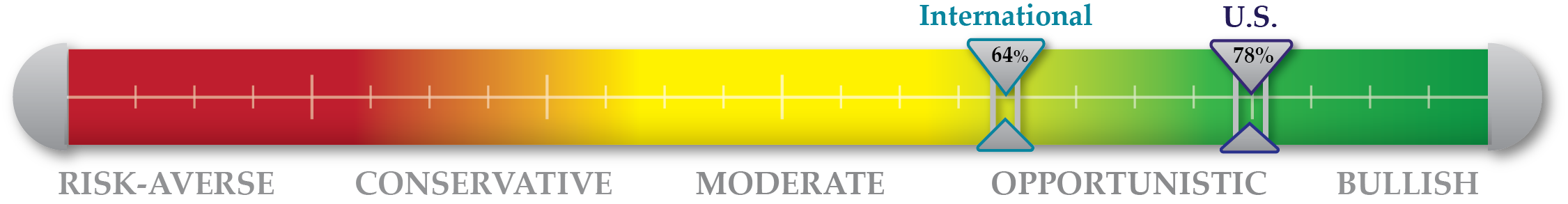

The U.S. and China resuming trade discussions is a positive sign for what has become an escalation of trade uncertainty and disputes in 2018. With Chinese retaliatory restrictions on U.S. goods looming, the tone and outcome of these discussions will be important for the international markets in the near-term. Lagging growth abroad is a point of concern with important events such as Brexit decisions and trade discussions on the horizon. Domestically, equities had a good July and the economy remains strong but trade uncertainty still casts a shadow. The Federal Reserve is expected to raise rates in September, which could put pressure on bond issuances with higher borrowing costs resulting in possibly less private-sector investment. We enter August 80% invested in our tactical U.S. strategy and 62% invested in our tactical international strategy.

NorthCoast Navigator

|

Negative Indicators |

Neutral Indicators |

Positive Indicators |

|

|

Valuation Both P/E and forward P/E ratios rose very slightly from last month as a result of positive market action along with positive corporate earnings. |

Technical The University of Michigan Consumer Sentiment Survey remained very high in August. The Bull/Bear ratio swung slightly higher in favor of the bulls as the current bull market became arguably the longest on record in August. |

Sentiment The VIX was unchanged and still sat below 13 at the end of August and the Relative Strength Index rose slightly. The S&P 500 now sits 3%, 5% and 6% above its 50-, 100- and 200-day moving averages respectively.

|

Macroeconomic U.S. GDP was revised up to a growth rate of 4.2% in the second quarter. Personal-consumption expenditure rose in the second quarter at a 3.8% annualized rate. |