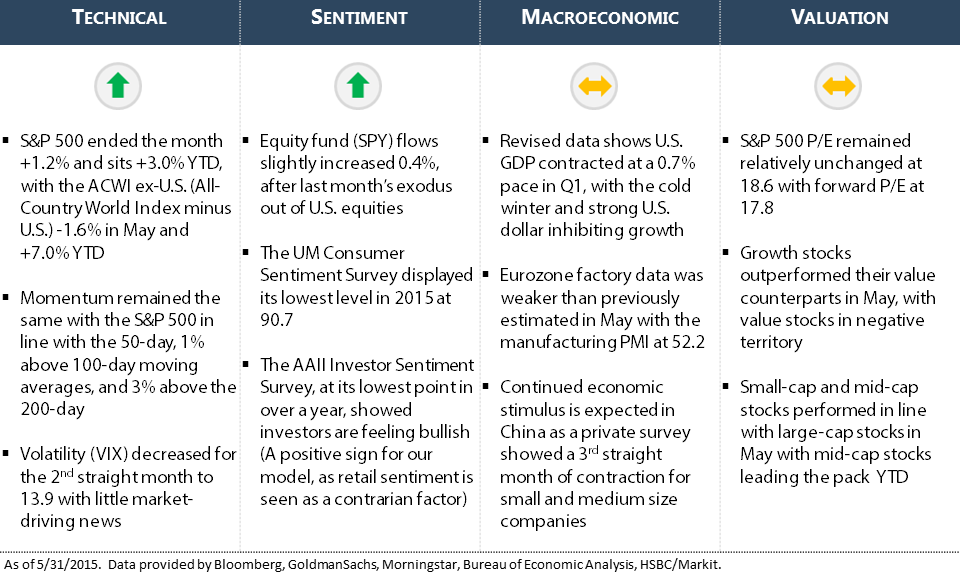

As 2015 approaches its midway point, U.S. equities continue their soft ascent in positive territory. The S&P 500 gained +1.2% in May with an annual gain of 3.0% YTD.

The strength of the U.S. economy, arguably the biggest contributor to equity performance in 2015, is beginning to show weakening signals after months of increasing momentum. Even though unemployment and jobless claims remain at pre-recession numbers, it appears the cold winter had a more chilling effect than previously estimated. A downward revision to the GDP data pushed it into negative territory, showing the U.S. economy contracted in Q1 at a 0.7% annual rate. The news comes at a time when the Federal Reserve is rounding third base in its decision to raise interest rates for the first time since 2007.

Globally, international stocks have flourished in 2015 with the ACWI (All-Country World Index) ex-U.S. +7.0 YTD, after a slight pullback in May at -1.6%. International economies continue to play catch-up with the U.S. in terms of post-recession stimulus. Japan, China, and the Eurozone are driving equity performance with their respective economic packages.

NorthCoast Reduces U.S. Equity Exposure

As equities softened in early May with minor pullbacks, NorthCoast aimed to take advantage of the attractive entry points. Equities then rebounded and moved higher, providing a needed boost to strategies such as CAN SLIM® and Legends Value. Later in the month, as macro-economic data weakened and valuation levels rose, NorthCoast began to reduce equity exposure across the board and increase cash holdings. In Tactical Growth, increased exposure to the Eurozone and fixed income replaced the U.S. equity sells.