What happened in March?

What happened in March?

Stocks pushed higher last week to close the month in positive territory as fixed income remained hindered by increasing interest rates.

While the “Trump trade” began to lose momentum, continued optimism in expanding global economies propelled equities. For example, while the SP financial sector (a previous leader of the Trump trade) declined 2.9% in March, the technology sector gained and has been the best performing sector YTD. The recent shift could mean that investors are relying on the data of a growing economy to make investment decisions over the belief in future fiscal policy, which has its uncertainties and doubts.

During the investor shift, stocks remained calm with minimal volatility. The CBOE Volatility Index posted its 2nd lowest quarterly average on record. Surveys in March measuring consumer and producer sentiment, or future growth potential, remained high coupled with macroeconomic data that showed a stable, growing economy in the U.S. and rebounding abroad.

For the month, U.S. equities (SP 500 Index) returned +0.7% and are now +5.9% YTD, with international stocks (MSCI ACWI ex-U.S.) +2.5% in March and +7.9% YTD. Fixed income remained muted across the globe. U.S. bonds (Barclays U.S. Aggregate Bond Index) declined a modest 0.5% and global bonds (JP Morgan Global Aggregate Bond Index) +0.1% in the month.

Moving into April

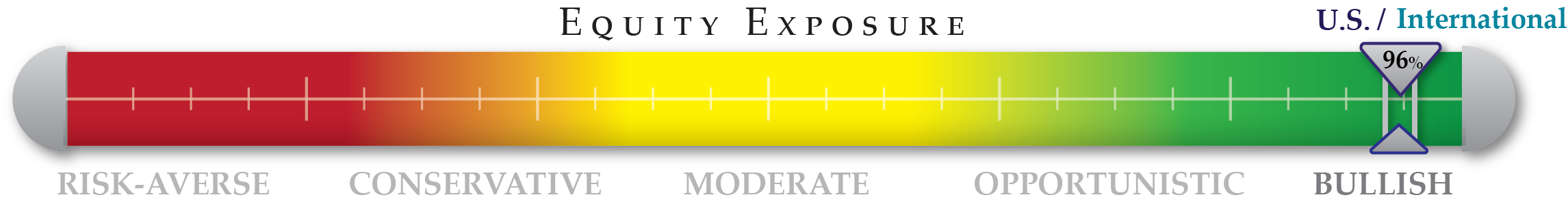

While macroeconomic data remained strong, producer and consumer sentiment moved higher in March. The mid-March pullback provided an opportunity to increase our equity exposure and take advantage of the short-term price discount. Even though valuation levels remain a point of concern, the surrounding data points provided a rationale for an almost full investment level. We enter the 2nd quarter 96% invested in both our U.S. and international tactical equity strategies.

NorthCoast Navigator

|

Negative Indicators |

Positive Indicators |

|

|

||

|

Valuation P/E multiple of the SP 500 is 21.8, 27% higher than its 10-year average while forward P/E remained at 18.3. |

Macroeconomic Housing starts jumped to an almost 10-year high coupled with a strong labor market and growing inflationary metrics. |

Sentiment Equity (SPX) flows increased 1.1%. UM Consumer Sentiment survey improved to 96.9. U.S. PMI dipped from February but remains healthy at 57.2. |

Technical Long-term momentum remained strong with the S&P 500 7% above the 200-day moving average while 1% above the 50-day moving average. |

||