By NorthCoast President & CEO, Dan Kraninger

“The only function of economic forecasting is to make astrology look respectable.”

-- John Kenneth Galbraith

2015 is here and with it comes the inane Wall Street annual ritual of consensus forecasts. For years I have kept Barron’s January issue as a constant reminder why data and discipline will outperform instinct and intellect over time. Every year experts from the biggest firms on Wall Street gather to predict how markets will unfold in the year ahead. Their firms manage billions, employ thousands, and arguably have more access to information and insight than anyone else, and as you probably already well know, their forecasts tend to be laughable when looking back at them each December.

Let’s take a couple of big doozies from 2014 -- bonds crashing and oil not. Twelve months ago, with long-term Treasuries trading with a 3.9% yield, everyone pounded his or her table about the inevitable inflation pick-up and bond crash. And they’re still waiting, I guess. Long-term Treasuries closed the year yielding 2.7% and made a robust +27% return. In response to this forecast, many folks sold their bonds and bought income generating assets like limited partnerships (many of which are linked to oil.) And what was the biggest investment story of the year? Oil. A certifiable crash. The kind that puts companies out of business. Crude oil dropped 50% in value – from well over $100/barrel to close the year near $50/barrel. How many experts do you think saw this one coming last January? The answer, of course, zero.

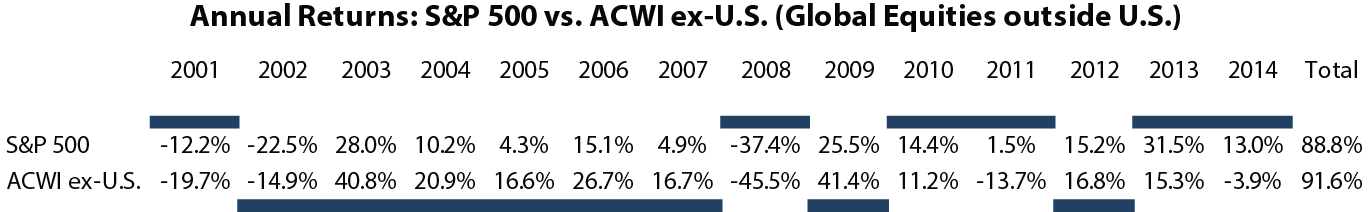

So be careful of consensus. Often it is misleading. One current issue, in particular, that seems to be close to consensus is the gloom and doom associated with international investing. Because U.S. equities have outperformed international equities for two years, many are selling their international exposure even though stocks outside the U.S. represent 50% of global equity. As the table below demonstrates, international stocks play an important role in diversifying one’s portfolio and have terrific periods of outperformance vs. U.S. stocks.