“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

– Ben Graham

Uncertainty and surprise lead today’s market volatility

U.S. futures were pointed lower this morning and U.S. equity markets are expected to move in volatile action today as a result of the U.S. presidential election. In our position, last night’s election results do not indicate any substantial change of equity outlook in the near term.

The macroeconomic, sentiment, and technical indicators that we monitor all remain positive and indicate a market primed to advance in the near-term (i.e. unemployment remains at historic lows, wage growth improving, better than expected GDP growth, manufacturing sentiment continues to increase and technical moving averages are providing positive momentum).

We will monitor any new information in the coming days and weeks to determine the most appropriate and prudent allocation of capital and will adjust our exposure as necessary.

Economic policy change is the key factor to monitor in the coming months

Donald Trump ran a campaign that was adamant about a shift away from “business as usual” when it comes to global trade, securities, and entitlements – all of which impact economic markets. Much of this uncertainty is the cause of today’s volatility. There are two things that equity markets do not respond well to; 1) uncertainty and 2) surprise. They received a healthy dose of both last night. However, the data has not changed and markets will quickly digest the election results. Here is an article from our partners at iShares® by BlackRock® that highlight the short-term impact – Post-Election Landscape: Impact of U.S. 2016 election on investing

Headline news impacting global markets is nothing new

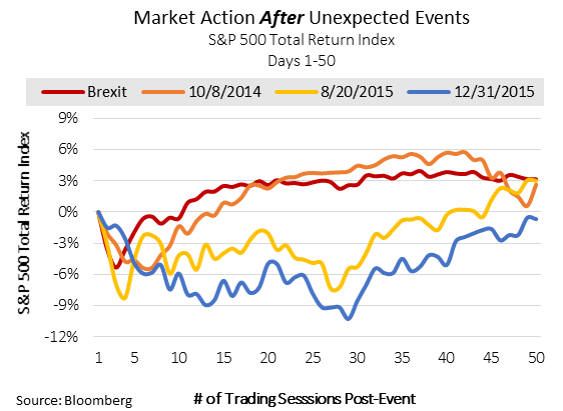

We encourage you to revisit our previous publications (listed below) over the last three years when headlines impacted markets in a limited time range. Each short-term setback was a market inefficiency based on news instead of market-moving economic data.

June 24, 2016; The Brexit vote – Global markets plummeted in one trading session after Great Britain voted to exit the European Union. However, once investors obtained all the necessary data and market efficiency prevailed, U.S. equities have advanced over 5% since that day. Read our statement published on June 24, 2016.