What happened in November?

What happened in November?

Global equities continued to move higher as major market indices reached new milestones again in November, specifically the Dow Jones Industrial Average (DJIA) which moved above 24,000 for the first time ever. Coming 30 trading sessions after its last, this marks the 5th thousand-point milestone this year. The S&P 500 also hit a new high this year, passing 2,600 and moving up 3.0% for the month. Helping the cause, the U.S. GDP growth rate was revised up for the third quarter to 3.3% and the International Monetary Fund raised its global growth forecasts to 3.6% for this year and 3.7% next year.

Proposed U.S. tax reform legislation, a big driver of recent market advances, hit a snag over concerns about the impact of a significantly lower corporate tax rate on federal deficit. This complication will delay the next senate vote and likely extend the previously aggressive timeline of passage. In monetary policy news, Janet Yellen provided a mostly positive assessment of the U.S. economy in her congressional testimony and confirmed the Fed’s continued plan of gradual rate increases. Across the globe, a strong month (and a stronger year) for tech stocks that pushed the sector of the MSCI Emerging Markets Index above the financial sector for the first time since 2004 ended with declines in the final trading days of November.

November by the numbers:

U.S. Euities | S&P 500: +3.0%

International Equities | ACWI ex-U.S.: +0.8%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: 0.0%

Global Bonds | JP Morgan Global Aggregate Bond Index: +1.0%

Moving into December

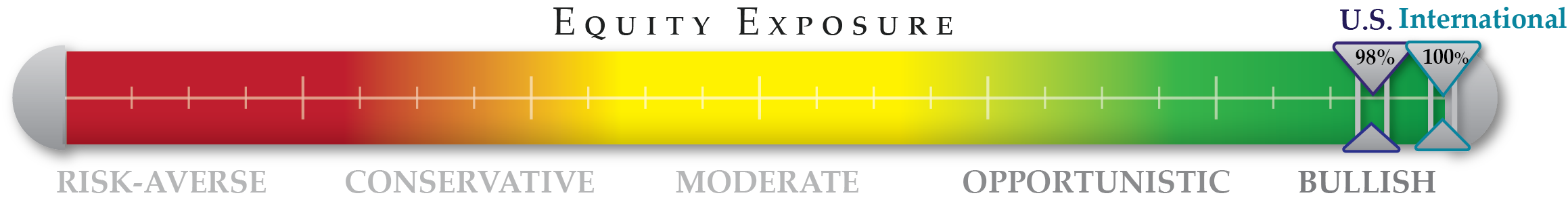

As the end of 2017 approaches, markets will be focused on how well global economies can sustain their current positive growth paths along with the passage of U.S. tax legislation. Currently, only thirteen countries are in recessions, which is the lowest number since 2007. As we close out the year, NorthCoast U.S. and international tactical equity strategies are near 100% invested, indicating a bullish posture in the near-term.

NorthCoast Navigator

|

Negative Indicators |

Positive Indicators |

|

|

|

Valuation Valuations became even more stretched as the S&P 500 P/E ratio topped 22 for the first time in 2017. |

Technical U.S. equity momentum drove forward with the S&P 500 3% above its 50-day moving average, and 5% and 8% above its 100-day and 200-day, respectively. p> |

Macroeconomic Leading Economic Indicators topped 130, the highest reading in 2017 along with Q3 GDP revised up to 3.3% growth. |

Sentiment Conference Board’s consumer confidence measure rose to its highest level since Dec. 2000. Homebuilder sentiment and U.S. Credit Index composite both rose in November. |