What happened in November?

November by the numbers:

U.S. Equities | S&P 500: 3.6%

International Equities | ACWI ex-U.S.: 0.9%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: -0.1%

Global Bonds | JP Morgan Global Aggregate Bond Index: -0.8%

Moving into December

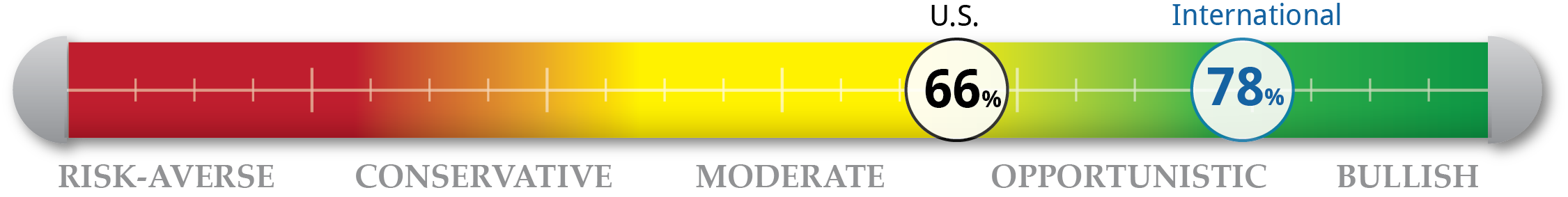

With the equity market having performed above expectations this year despite no firm resolutions on multiple geopolitical issues, there is a chance that investors will consider locking in their gains in December and avoiding any increase in volatility. Valuations remain elevated as domestic equities notch record highs. These gains have come on the back of positive signs of trade resolution but with little tangible progress. We see the risks and uncertainties in U.S. equities as only magnified by the growing valuations. International equities are looking more attractive at this time due to their less inflated valuations. We are currently 66% invested in our domestic equity strategy and 78% in our international equity strategy. We have more than adequate liquidity to take advantage of a buying opportunity and protection against a more aggressive slide like we saw last December.

NorthCoast Navigator

|

Negative Indicators |

Neutral Indicators |

|

Positive Indicators |

|

Valuation U.S. equity valuations moved even higher after last month’s big, general gains. Large and mega-cap stocks remain the most overvalued as they continue to outpace the general market. Average P/E ratios for S&P 500 companies was up to 20.89. |

Sentiment We saw little change to sentiment indicators in November. The University of Michigan Sentiment Survey ticked one point higher from October, a very small gain. Investment flows into equity fund SPY were slightly positive last month. Overall, small positive change.

|

Macroeconomic There was little change in macroeconomic indicators from last month. Some positive data was released, but there is continued concern of slowing business investment, especially if it begins to affect employment. Unemployment remains historically low at this moment. Concerns over international political unrest and trade discussions persisted. |

Technical Trend-following technical indicators remained positive as the market rallied in November. The S&P 500 now sits 4%, 5% and 7% above its 50-, 100- and 200-day moving averages, respectively. The relative strength index, a measure of momentum, rose and the CBOE VIX, a measure of volatility, moved lower.

|