U.S. equities (S&P 500) opened the year with an almost 6% decline in January, remained flat with a down-then-up February, and have since rallied over 6% in March to end the quarter +1.2% YTD. International equities (ACWI ex-U.S.) experienced even greater gains in March with a +8.1% return, paring earlier losses and sit -0.4% YTD.

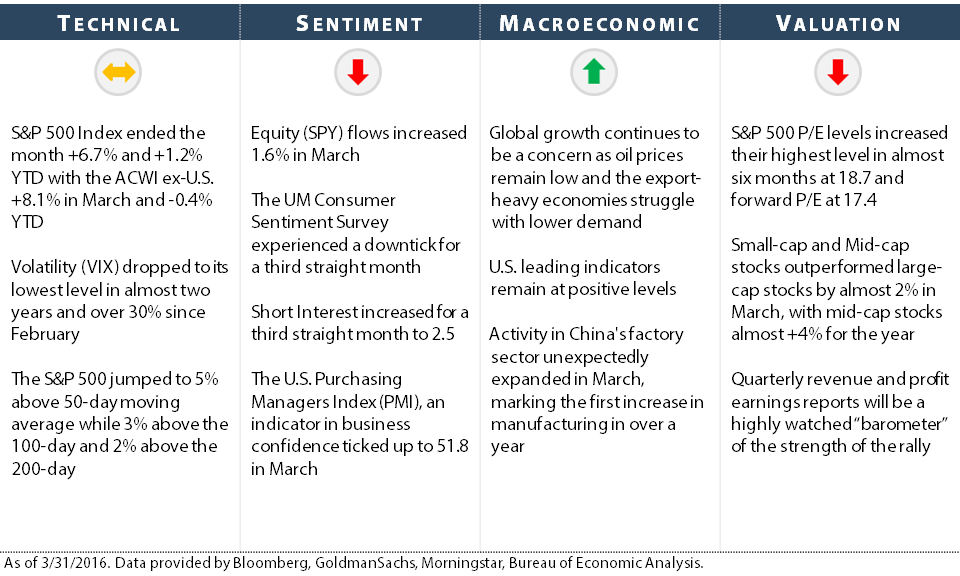

Much of the rally can be attributed to investors’ favorable reaction to a rise in oil prices and a lack of negative headlines across global markets. Fed Chair Janet Yellen recently stated that the economy might not yet be ready for another rate hike, which was welcomed news for the market in the short-term. While economic growth prospects in the U.S. and abroad remains stable yet sluggish, stocks extended their 7th straight year in positive territory since the March 2009 low. The late February-into-March rally elevated prices and raised valuations, thereby reducing the attractiveness of entering new positions. Much of our concern surrounding market-moving indicators in early March still exist as we move into Q2. Consumer sentiment, producer sentiment and economic surprise indices remain soft. Technical indicators remain stable, yet neutral. In the face of weaker sentiment and valuation data, macroeconomic indicators remain bullish.

Moving into Q2

In our tactical equities, we continue to hedge against the aforementioned market risks with a healthy cash position. We ended March with just over 60% equity exposure in our U.S. tactical strategies and 85% in our international portfolios. The almost 40% cash hedge in the U.S. strategies can be attributed to weakened valuation and sentiment metrics.