"Volatility is not the same thing as risk, and anyone who thinks it is will cost themselves money" - Warren Buffett

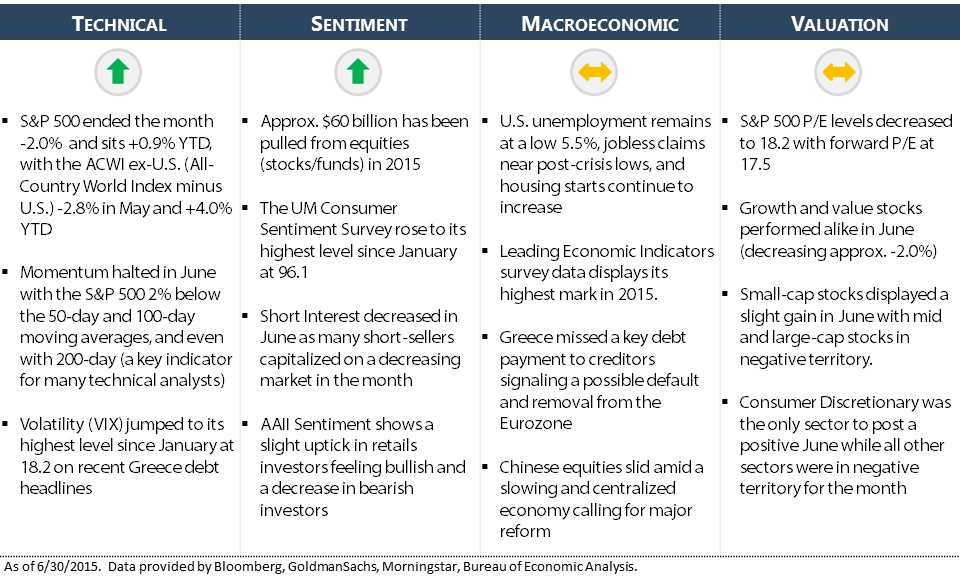

Most of the major indices are hitting the reset button today as we enter the 2nd half of 2015 with the S&P 500 +0.9% YTD after a -2.0% June and a flat Q2. The Dow is -1.2% YTD and the Nasdaq is +5.5% YTD. Health Care (+8.7%) and Consumer Discretionary (6.0%) stocks led all sectors in the first the six months of 2015 while Utilities (-12.1%), Energy (-6.0%), and Industrials (-4.1%) lagged. Small and mid-cap stocks outperformed their large-cap counterparts, while growth stocks slightly outperformed value. Thanks, in part, to multiple quantitative easing programs, international stocks (as measured by the ACWI ex-U.S.) are +4.0% YTD.

Two major stories continue to dominate the global financial headlines; 1) the Federal Reserve’s inevitable yet undetermined decision to raise federal interest rates, and 2) Greece’s showdown with creditors and possible default/removal from the Eurozone. While these events create uncertainty in equities, they only account for a few of the many factors and signals that determine how we invest moving forward.

Where do we go from here?

After a yearly-low exposure level (74% equity invested) in some of our tactical strategies at the end of May, we strategically increased our exposure throughout June. Sustained U.S. economic growth, along with strong analyst sentiment and attractive valuation levels, provided good entry points into positions as other reached their respective sell-stops and were liquidated. The nearly 2.0% decline in June stemmed from uncertainty in the equity markets. But, as Warren Buffett so eloquently put, it is important to decipher the difference between “risk” and “volatility”. As many signals continue to paint a positive outlook moving forward, we enter Q3 in an opportunistic position and will look to increase exposure if the data warrants.