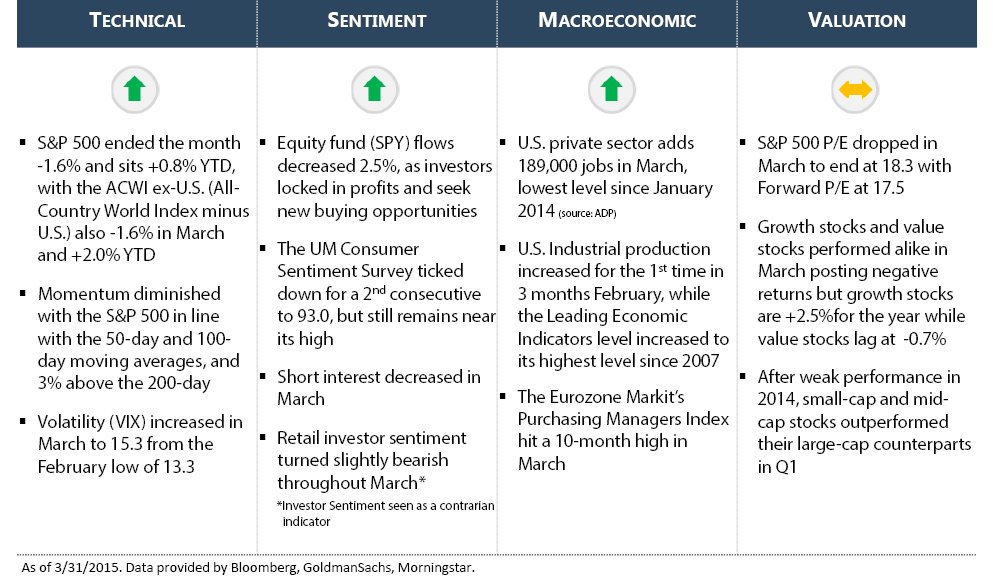

After a rocky start to January, equities (S&P 500) rebounded in February, and bounced around in March to end the quarter 0.8% YTD. Even though much of the headline news focused on global geopolitical tensions, fragile economies in the Eurozone and Asia, and decreasing oil prices, stocks continued to show resilience in 2015.

Economic stimulus packages are propelling equities in Japan and China as both markets are experiencing big gains this year. International equities (MSCI All-Country World Index minus U.S.) are +3.5% YTD. In the U.S., similarities to 2014 persist: a cold winter kept retail sales at bay with hope for a spring renewal on deck; unemployment is decreasing with fewer jobless claims; and even though wage growth remains stagnant, the economy continues to improve.

During the first three months of 2015, our tactical strategies (including CAN SLIM® and Tactical Growth) maintained equity exposure between 80%-90%. As markets rebounded in February, we locked in profits and reduced exposure due to increasing valuation concerns. Along the way, minor pullbacks in March provided attractive entry points as our overall market position remained "Opportunistic". We believe this is a favorable environment to make money but risks exist.

Heading into the second quarter, we will closely monitor macroeconomic data along with a pivotal earnings season. Should the data warrant a change in our exposure or specific positions, we will act accordingly.

Quote by Jean-Baptiste Alphonse Karr