What happened in February?

What happened in February?

February began with an abrupt reintroduction to stock market volatility. A selloff that started on January 26th extended to February and shaved 10% off of the S&P 500. This is the first time the general market index was pushed into correction territory since late 2015. The reasons behind the selloff are numerous but are largely based off a realization of and reaction to the increased likelihood of a spike in inflation and subsequently increasing interest rates and bond yields. One concern for equity investors is that rising bond yields will attract more investors to bonds, which will lower demand for stocks and pull prices lower. However, a strong Q4 earnings season and continually strong macroeconomic data drove the market higher from the bottom on February 9th. During this positive run of 5%+, the S&P 500 recorded its best week (2/12 – 2/16) since 2013. The new Federal Reserve Chairman, Jerome Powell, gave testimony to Congress affirming the strong state of the U.S. economy, accrediting speculation over rising interest rates and driving the general market down slightly at the end of the month. U.S. bond prices were pushed down by the 10-year Treasury yield climbing to 2.86% at the end of February from 2.73% at the start the month (bond prices decline as yields increase).

Across the globe, international stocks moved in sync with the U.S. stock market’s fall and subsequent rebound during the month. However, international markets ended the month lower than the U.S. due to similar inflation concerns, a lack of progress from Brexit discussions and Chinese factory activity slipping to a 19-month low.

February by the numbers:

U.S. Euities | S&P 500: -3.8%

International Equities | ACWI ex-U.S.: -4.7%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: -1.0%

Global Bonds | JP Morgan Global Aggregate Bond Index: -1.0%

Moving into March

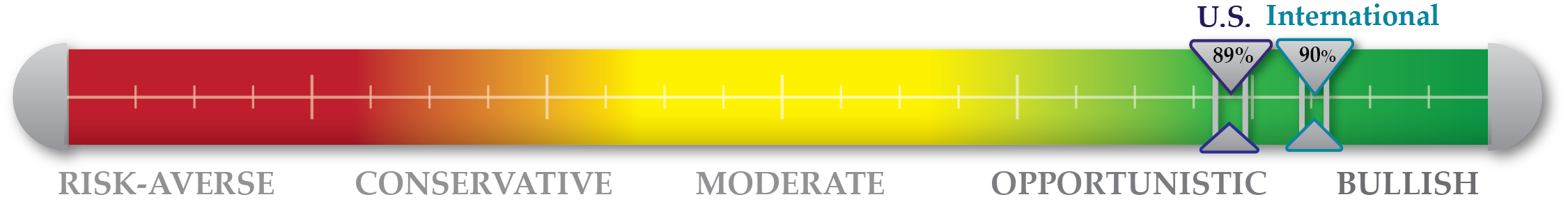

Markets are expected to remain volatile moving into the final stretch of the first quarter. Investors’ focus will be largely on the Federal Reserve Board’s decisions regarding rate hikes and inflation expectations. Macroeconomic data will also play a role in helping determine the current state of inflation. Actions by corporations in the coming months will begin to paint a clearer picture of the impact of the recent tax cuts on the U.S. economy and financial markets. We enter March 89% invested in our domestic tactical equity strategies and 90% invested in our international tactical equity strategies.

NorthCoast Navigator

|

Negative Indicators |

Neutral Indicators |

Positive Indicators |

|

|

Valuation With the market rout during the month, valuation indicators improved slightly, but still showed an expensive market with P/E ratios hovering around 22. |

Technical The VIX climbed during the month, ending at 20 after averaging 11 throughout 2017. Moving averages all moved lower and the 50-day turned slightly negative, though 100 and 200-day remained positive. |

Macroeconomic The U.S. labor market showed signs of strength during the month with U.S. new jobless claims falling to the lowers level since 1969. Wage growth moved higher, an indication of overall strength in the economy. |

Sentiment Equity flows out of the market were less significant than in past corrections. The bull-bear ratio remained steady at its January level and the University of Michigan Consumer Sentiment survey ticked higher in February. |