“What’s the benefit of a 30-stock portfolio? Why the difference in position sizes?”

Response by: Andy Burrow, Client Advisor

Response by: Andy Burrow, Client Advisor

NorthCoast’s individual stock strategies are constructed using approximately 30 individual equities. This very calculated decision was made in order to strike a balance between our aptitude for stock selection (using a proven, system-driven process), and the need for diversification within the portfolio. Holding approximately 30 positions allows us to limit the impact of “noisy” trades and diminishes the impact of individual losses in the strategy. On the flip side, holding more than 30 stocks begins to dilute our ability to add value through our stock selection methodology. This methodology is one of the key factors that puts us in the best position to generate strong risk-adjusted returns.

Think of making bets at the poker table when the odds shift in your favor… A few big bets can sway your fortune either way, but placing many modest wagers repeatedly and methodically will give you a higher probability of winning the hand. By making such “wagers” within our strategies, we aim to diminish or reduce the violent swings that one may experience when investing in the equity markets.

A 30 stock portfolio also adds another arrow to our risk management quiver: position sizing. NorthCoast initiates positions in a portfolio within a range of 2%-4% depending on the expected volatility and return for that name. We would much rather sell out of a losing position at a 2% weight than a position that makes up a significant portion of a portfolio. Those names which we believe have a greater chance of significant returns are initiated closer to 4%. Again think of a poker game, a good player will modestly adjust the size of his bets when the odds of winning a hand change. This layer of risk management is less visible than our cash-scaling component, but no less important.

“With bad news all around, why is NorthCoast still invested?”

Response by: Joe Merkle, Client Advisor

Response by: Joe Merkle, Client Advisor

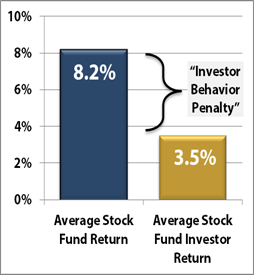

This is the cost of riding the emotional roller coaster known as the stock market. Investing in public companies, aka stocks, is built upon making decisions using cost/benefit analysis. In other words, how much will it cost me for a desired unit of benefit? Equally important, what are those costs? You want the benefit of lower volatility in your portfolio? That will likely cost you upside growth. You want growth? The likely cost is periodic volatility. But what about the emotional costs?

"Wall Street Plummets on Fears of China”, or “Death Cross Scares Investors Out of Market” are common news headlines over the last few weeks. You might have even seen my personal favorite: “100% Chance of 50% Crash.” When reading headlines like this, it becomes incredibly challenging to keep our assets invested. For our clients and myself, years of personal savings, retirement funds, and even college tuition funds are exposed to these potential risks.

"Wall Street Plummets on Fears of China”, or “Death Cross Scares Investors Out of Market” are common news headlines over the last few weeks. You might have even seen my personal favorite: “100% Chance of 50% Crash.” When reading headlines like this, it becomes incredibly challenging to keep our assets invested. For our clients and myself, years of personal savings, retirement funds, and even college tuition funds are exposed to these potential risks.

While there are many factors that lead us (individual investors) to an investment decision, one key factor is emotion. Staying disciplined and focusing on market data instead of market drama allows us to achieve our financial goals. The problem: staying disciplined is challenging, because it never feels right at the most important times; when the market seems wrong.

For over 25 years, NorthCoast has worked to develop a data-driven, unemotional investment model. It has proven to help us capture upside when the market is rising, and protect our clients from catastrophic losses in bear markets. While the unemotional nature of the investment strategy can sometimes feel unresponsive, passive, or downright wrong, the exact opposite is true: by remaining disciplined and making sound, unemotional investments decisions, we are more likely to help you achieve the long-term financial goals that you originally planned for when investing.

Performance Graph: Source: Dalbar Inc., Quantitative Analysis of Investor Behavior