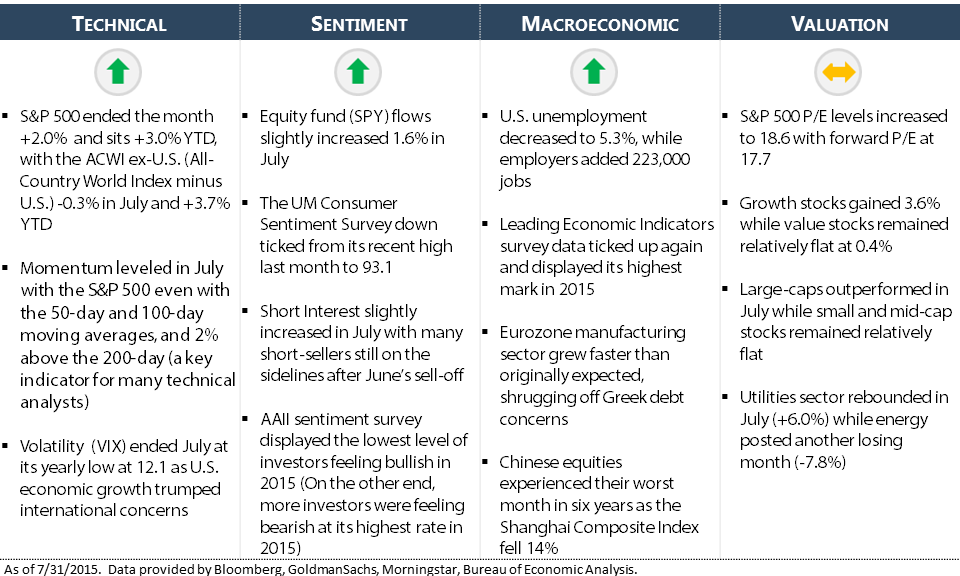

U.S. equities found ground to stand on at the end of the month as large-cap stocks (S&P 500) ended the month +2.0%, and now sit 3.0% YTD. Early in the month, the majority of U.S. equities gained momentum on the news of an additional loan reform for Greece and additional central banking measures to stabilize China’s equity market. However, the international concerns impacted domestic stocks later in the month as fears of contagion pushed U.S. equities lower before recovering to end the month in positive territory.

Domestically, economic growth likely rebounded in the 2nd quarter as GDP grew at an annualized 2.9%. Increased consumer spending and housing starts offset the drag from the energy sector, particularly oil. The Federal Reserve unanimously decided to keep rates near zero until the next policy meeting. The policy makers continue to see an improving economy but gave no timetable for when the increase in rates could occur.

With little data changing across our four dimensions of indicators, NorthCoast maintained a cautiously bullish (Opportunistic) posture throughout July. The individual equity strategy, CAN SLIM®, averaged an 85% equity position while the managed ETF solution, Tactical Growth, remained at 93% equity invested (42% U.S. / 51% International).