Fear, concern, and uncertainty have dominated headline news since late August when global equities began a quick descent, followed by a series of volatile price movements. The S&P 500 experienced an up or down move greater than 1.0% on 10 of the 21 trading days in September. These headline words referenced above are emotional and are more often used by people interested in selling newspapers than managing money.

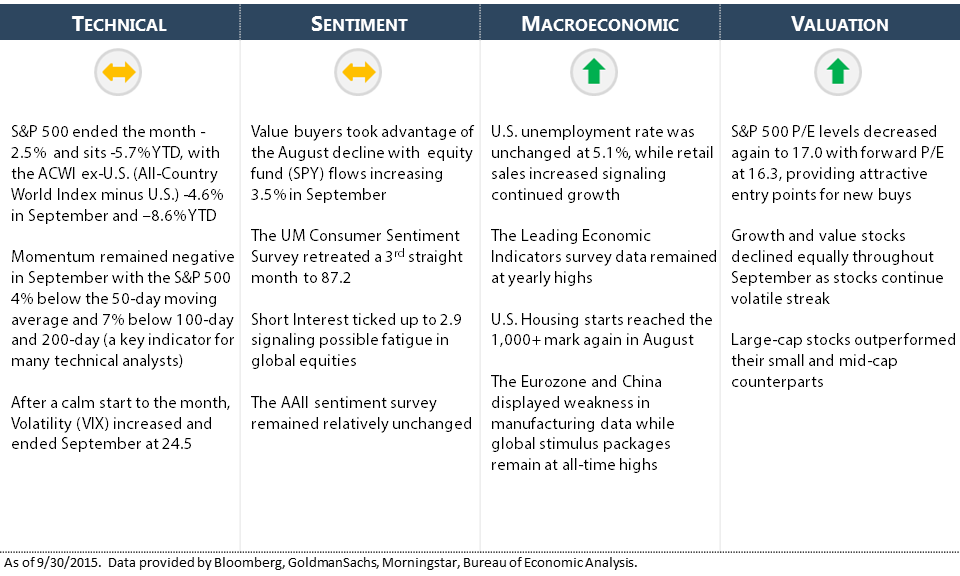

As investors, we make decisions about what we know based on facts. From our perspective, little has changed in the data since the major decline on August 25, 2015. U.S. growth continues to move forward. Individuals receiving jobless claim benefits hit a 15-year low, manufacturing output increased, and the home price index rose, signaling continued demand among consumers. Globally, data signals painted a more moderate picture. Growth in China is expected to slow as evidenced by the government’s attempt to prop up equities by devaluing its currency. Economic stimulus remains at all-time highs in Japan and the Eurozone as those regions recover from weakening growth. The composite result of the 40+ indicators NorthCoast monitors continued to be positive. However, risks do exist. These risks provided the rationale for an average cash position of 20% in CAN SLIM® and an almost 10% fixed income position in Tactical Growth ETF during September.

The plan moving forward? As we move into the 4th quarter, our data indicates the potential for returns outweigh the associated risks. There may be a time to take advantage of recent price declines to invest in new positions. As always, we continue to monitor these metrics daily, and if and when the data warrants a change, we’ll adjust our exposure accordingly.