What happened in July?

Despite unsettling news in the tech sector, U.S. equities rose in July on a more optimistic trade outlook, generally positive earnings data and economic growth. The 2nd quarter earnings season kicked off with notably negative news from Facebook and Netflix as both tech giants struggled to keep up new user acquisition. Facebook’s report showed the impacts of the data scandal earlier this year with lagging daily user data and unexpectedly negative guidance for the remainder of the year. The NYSE FANG+ index which is comprised of popular tech companies like Facebook, Amazon and Netflix slid into correction territory for the second time this year. Overall, earnings season has proved largely positive so far with just over 83% of companies in the S&P 500 having reported and 73% of those reporting above expectations.

International economic figures released during the month lagged behind the U.S., which posted a 4.1% GDP growth rate during the second quarter, its largest quarterly increase since 2014. The Eurozone economy grew at a rate of 1.4% during the same period, the slowest in 3 years, and Mexico’s economy contracted. The Chinese manufacturing purchasing manager index slid to a 5-month low in July, possibly as a result of the impacts of U.S. tariffs and trade disputes.

July by the numbers:

U.S. Equities | S&P 500: +3.7%

International Equities | ACWI ex-U.S.: +2.4%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: 0.0%

Global Bonds | JP Morgan Global Aggregate Bond Index: -0.1%

Moving into August

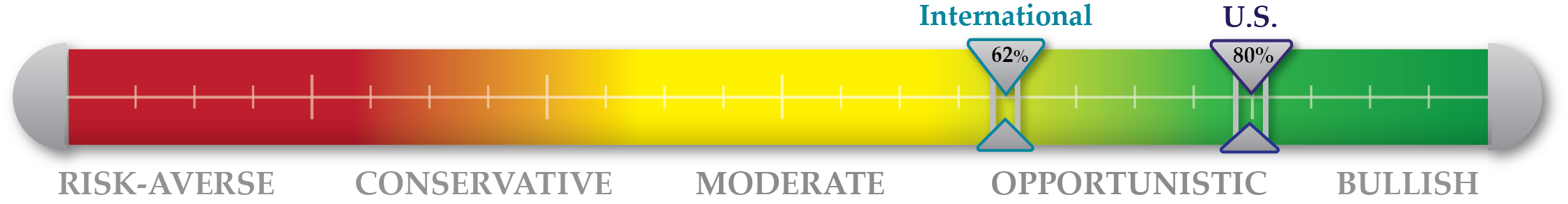

The U.S. and China resuming trade discussions is a positive sign for what has become an escalation of trade uncertainty and disputes in 2018. With Chinese retaliatory restrictions on U.S. goods looming, the tone and outcome of these discussions will be important for the international markets in the near-term. Lagging growth abroad is a point of concern with important events such as Brexit decisions and trade discussions on the horizon. Domestically, equities had a good July and the economy remains strong but trade uncertainty still casts a shadow. The Federal Reserve is expected to raise rates in September, which could put pressure on bond issuances with higher borrowing costs resulting in possibly less private-sector investment. We enter August 80% invested in our tactical U.S. strategy and 62% invested in our tactical international strategy.

NorthCoast Navigator

|

Negative Indicators |

Neutral Indicators |

Positive Indicators |

|

|

Valuation After a positive month for the S&P 500, valuation indicators remained relatively unchanged. P/E and forward P/E ratios both ticked slightly higher. |

Technical The S&P 500 now sits 2%, 4% and 5% above its 50-, 100- and 200-day moving averages, respectively. The relative strength index rose significantly and the VIX dropped below 13 for the first time since January. |

Sentiment The Bull/Bear ratio rose significantly after dipping to a one-year low last month. Flows into the S&P 500 equity fund SPY were positive for the month. The UM Consumer Sentiment Survey remained unchanged. |

Macroeconomic U.S. wages and salaries grew at their fastest pace in a decade during the second quarter. Personal consumption expenditures and income both increased in June. GDP grew at a rate of 4.1% in the second quarter. |