President & CEO Dan Kraninger reflects on the 3rd quarter of 2019 and provides insight moving forward.

“People only see what they are prepared to see.” - Ralph Waldo Emerson

Count the number of F’s in the following sentence…

FINISHED FILES ARE THE RESULT OF YEARS OF SCIENTIFIC STUDY COMBINED WITH THE EXPERIENCE OF YEARS.

How many did you count? Try again and count the number of F’s carefully. In two decades, I’ve never referenced this fun brain trick in a newsletter but I often use it in public presentations. The common answer is 3, then 4 and then 6 (look to the bottom for the correct answer). I first saw this in 1994 and it changed my life. I was working at Merrill Lynch and struggling to understand why there were so many mutual funds that were consistently underperforming their benchmarks. Everyone worked hard and was really smart, so what was the source of the underperformance? It was then when I attended a workshop where the facilitator introduced me to this exercise. He explained that many people see only 3 F’s because our brains read the word “of” and process it as a “V”. So when counting, we skip over. We see it but don’t register it.

This led me to rethink my approach. I began devoting much of my time and energy into the world of behavioral finance which was just beginning to find its roots in 1994. Traditional finance at the time held that (1) both the markets and investors are rational and that (2) investors have perfect self-control. Behavioral finance introduced the concept that we are human – irrational, biased, angry, loving, hopeful, excited, and scared beings. Our decisions are more influenced by our emotions than we care to admit. I left Merrill in 1996 because I believed this is why so many managers underperformed and why benchmarks were winning. Managers were human and making bad investment decisions based on their feelings and benchmarks, of course, did the same thing every day without judgement or emotion.

I’m bringing this up because not much has changed in 25 years and I’m starting to wonder if things are getting worse. With simple-to-use technology and almost non-existent trading costs, it’s never been so easy for people to make quick, knee-jerk decisions that can have significant ripple effects on their financial future. I’m starting to believe one bias in particular has worsened in part because of social media.

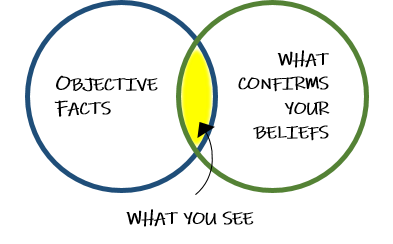

Confirmation bias is defined as the tendency to interpret new evidence as confirmation of one's existing beliefs or theories. My belief is that apps like Twitter and mobile notifications from subscribed websites are hurting people’s ability to see the other side of the coin because everything they hear, read, and see are confirmations of their own belief system. Every day, the market provides reasons to be bullish and reasons to be bearish and that’s what we are watching unfold in real-time . . . it’s a business of matching buyers and sellers in an auction market. However, successful investors are able to make the best, informed, and well-rounded decisions based on their own objectives.

Impeachment, an inverted yield curve, and missile tests are just some of today’s bearish headlines whereas, technology improvements, low interest rates, and good job and economic activity are some of the bullish justifications. Try to be measured on both sides. We use our Navigator (next page) to manage market conditions in an unemotional manner. We take into account 40 indicators that are historically predictive and reflect common sense. So what are we seeing right now? We feel the market will be generally neutral ahead… perhaps +3-4% over the next 6 months. Why? Technical and fear gauges are supportive of growth, economy is not great but good (and that’s ok), investor optimism is still healthy and valuations are better.

So in a nutshell, we are walking the line -- constantly mining for the F’s, testing and measuring data daily in order to make decisions designed to avoid bias. I encourage you to do the same, and we can help too. Our advisors have access to the same data that we use to manage the portfolios --- over 250,000 lines of source code. Put that to work for you – so whether you are thinking about a new investment, changing an existing investment or trying to align a portfolio with your outlook, give us a call. Besides having another set of eyes, I think you’ll find that decades of investment experience and terabytes of data at your disposal will help you see some F’s that you may have missed at first glance.