President & CEO Dan Kraninger reflects on the second quarter of 2018 and provides insight moving forward.

“Las Vegas is busy every day, so we know that not everyone is rational.”

- Charles Ellis

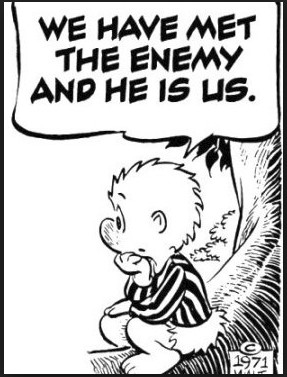

It occurred to me that I often talk about the importance of investment discipline and consistency in these letters but I rarely address the why behind it. Why are systems and models so critical when investing? The short answer is because we are human. Our ability to feel, think, hope, fear, love, and loathe defines us as humans but that same ability is also the root cause of investor malperformance. I feel very lucky that early in my career I detected the problem and then focused on systematic approaches to the markets.

In 1994 I was at Merrill Lynch doing what all new employees do . . . working long days, acting as a sponge and trying to make a name for myself. At that time Merrill Lynch had the second biggest mutual fund family in the country (behind Fidelity) and was a major force in the active management industry. Curiously though, few (if any) of the funds beat their passive benchmarks and this really bothered me. I didn’t know the answer but I certainly recognized there was a long term problem – how can these mutual funds sustain themselves if they underperform less costly benchmarks over time?

It was at this time, thankfully, a small bond department at Merrill (called UITs) launched a strategy called the “Dogs of the Dow” that was based on the book, Beating the Dow, by Michael O’Higgins. In it, Mr. O’Higgins described a strategy of buying the top ten high yielding stocks from the Dow Jones Industrial Average and holding them for exactly one year, no matter what. At the end of the year, the investor would rebalance to then again hold the top 10 yielders for the next year. This process was to be repeated year-over-year, without waver. When I read the book and spoke to the team supporting the launch I became amazed. Why? Because this strategy had outperformed the S&P 500 Index every rolling decade back to 1928. What?! You mean our team in the mutual fund division was in the office 12-hours a day and underperforming, and this strategy called for coming in the office once a year and was outperforming?! This was my first introduction to factor investing and behavioral finance.

The system worked because (1) it executed on a simple model (buying big cap stocks with high dividends) and (2) it eliminated human bias. It was a big “aha” moment for me and from that point forward I became obsessed with trying to identify superior models and eliminating my own investment prejudice.

Humans carry all kinds of emotional baggage every day – loss aversion, overconfidence, mental accounting, herd mentality, and one of my favorites -- hindsight bias. You’ll hear them all the time if you stop and listen - watch CNBC, talk with friends, or focus on your own words. It sounds like this today -- “value stocks don’t work, this is a growth market” or “international stocks are terrible, let’s change our allocation.” Well, of course, we now know growth stocks, led by the technology sector, had a better first half of 2018 and international stocks have trailed because hindsight is 20/20.

So you might often ask yourself what changes do I need to make in my portfolio in light of these recent trends. But the real question is why do anything? Doing nothing is often the right move. Try to avoid those short-term, reactionary conversations because in my opinion, they don’t really matter in the long-run. What matters is determining what you are trying to achieve over the next 5 to 10 years – knowing why you are investing. Once you know that, select a portfolio strategy designed to deliver. I suggest you set up a plan that allows for all different types of market environments… bullish, bearish, growth, value, domestic, international, etc. Take a step back, consult with our team, and establish a portfolio that is geared to perform not just over the next ten weeks, but the next ten years. Then the big question becomes, are you willing to remove yourself from the equation? If so, I bet the more successful you’ll be. I’ve done it since 1996 when I was first introduced to the Dogs of the Dow, and for my money, it’s made all the difference.