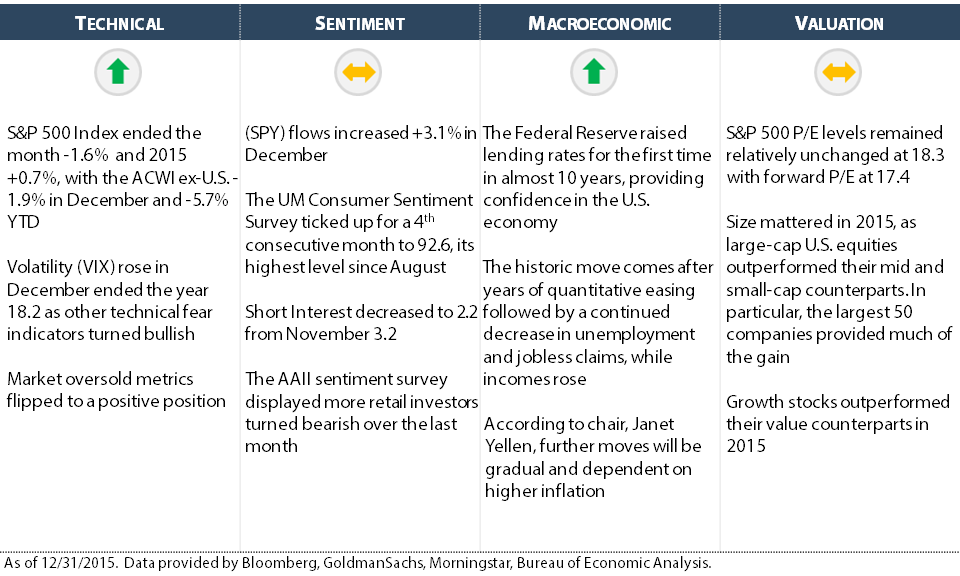

The U.S. stock market presented challenges in 2015. While major U.S. indices ended the year relatively flat, the average stock ended in negative territory. When the markets closed on December 31, the S&P 500 Index produced an annual return of +0.74%, while RSP (Guggenheim S&P 500 Equal Weight ETF), a gauge of the average stock price, ended -2.7%. The difference highlights that a majority of the slight gain was attributed to the largest market-cap names.

The U.S. stock market presented challenges in 2015. While major U.S. indices ended the year relatively flat, the average stock ended in negative territory. When the markets closed on December 31, the S&P 500 Index produced an annual return of +0.74%, while RSP (Guggenheim S&P 500 Equal Weight ETF), a gauge of the average stock price, ended -2.7%. The difference highlights that a majority of the slight gain was attributed to the largest market-cap names.

Global equities fared worse. The ACWI ex-U.S. declined with a -5.7% return. Bonds didn't help either. U.S. bonds (Barclays U.S. Bond Aggregate) provided only modest relief at +0.6% while global bonds (JP Morgan Global Aggregate Bond Index) ended -2.7%.

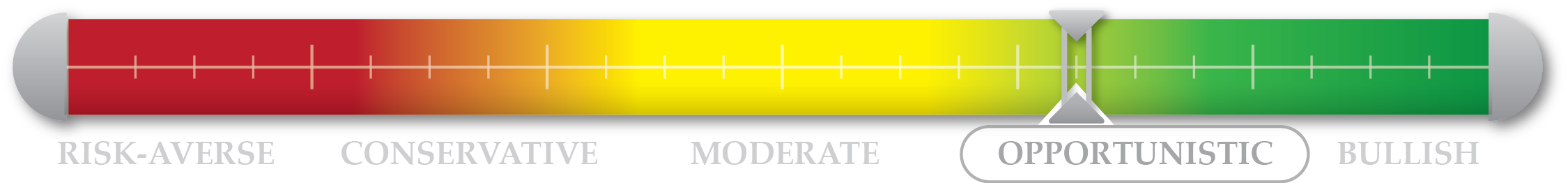

Many of our tactical strategies adjusted allocation to a more conservative posture as 2016 approached. CAN SLIM® reduced equity exposure from 85% in mid-December to 70% by year-end. The 30% cash position provides protection should equities decline to start 2016, and also the liquidity to invest should new opportunities arise. As always, we continue to monitor the risk metrics daily, and if and when the data warrants a change, we'll adjust our exposure accordingly.